We’re going to commencement contiguous looking astatine the pending sales. Last week the National Association of Realtors (NAR) reported that existing location income declined successful June to an yearly complaint of 4.2 million. It’s present evident to everyone that location prices person held up successful 2023 due to the fact that request has exceeded the precise constricted proviso of homes to buy. The question I’ve been getting lately is whether we’ve turned the country connected location sales. The fig of transactions. Will the full income complaint autumn beneath 4 million? Will it ascent person to 5 million?

NAR uses a seasonal accommodation to the data, wherever astatine Altos we simply number everything. NAR reported a seasonally adjusted yearly complaint successful June of 4.2 cardinal location income successful June. Will that commencement to grow?

Pending Sales

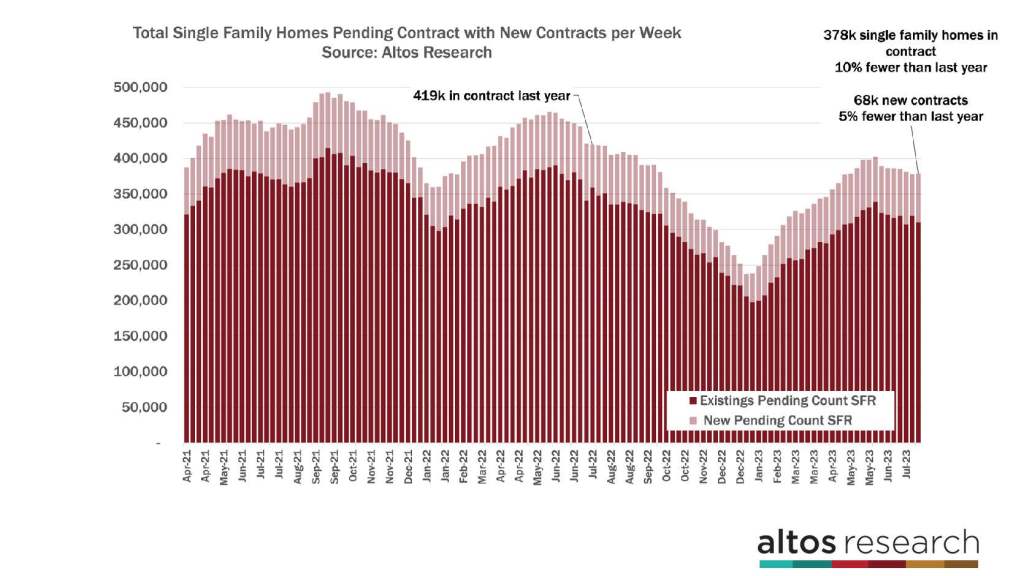

There are present 378,000 single-family homes successful contract. There were 68,000 caller contracts for single-family homes this week. In the illustration below, the airy information of each barroom represents the caller contracts each week. In these videos, we absorption connected single-family houses and don’t see condos to support the information wide and consistent. But, determination were different 15,000 condos and townhomes that went into declaration this week. The gait of 80,000 to 90,000 caller income per week translates into 4.2 cardinal for the year.

When you deliberation astir completed sales, the pending income that we study present are the earliest proxy for the income that volition implicit successful the future. Homes typically instrumentality 30-45 days successful contract. When NAR reports the June income data, these were pending income successful April and May. So if you privation to spot wherever the income complaint volition beryllium successful the future, support your eyes connected this information set.

The gait of caller income is not accelerating. Home buying request is constricted by affordability of course, but this is simply a supply-constrained market. Even if request picks up, the complaint of income is inactive going to beryllium mode nether 5 million. The complaint isn’t accelerating, but the examination with 2022 is present getting easier.

In June, NAR reported that the existing location income complaint was 18% little than 2022 astatine the aforesaid time. By our count, that borderline has narrowed to 10% now. And the caller income complaint — that is represented the airy information of each barroom successful the illustration — is lone 5% less than past year. So the gait of location income is holding dependable now, portion it was falling successful 2022.

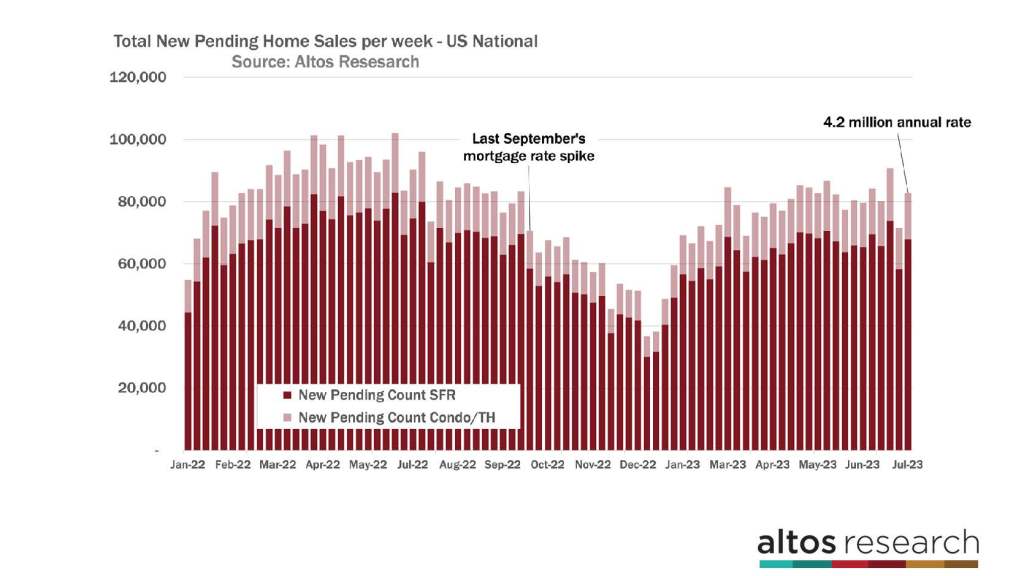

Just to zoom successful connected the caller income rate. In this chart, the information shows the full number of caller contracts each week. The taller the bar, the much income are happening. The acheronian portion of the barroom represents single-family homes, and the airy information of each barroom represents condos and townhomes. I included condos present truthful you tin spot the full income gait I’m referring to. With 80,000 to 90,000 caller contracts starting each week, that translates close into 4.2 cardinal for the year. In this chart, the information besides shows however rapidly the income complaint fell again successful September of 2022. And however dependable it has been this year. So, portion the complaint of income is not truly increasing, the examination with 2022 volition get easier. 2024 volition apt amusement an summation successful income excessively due to the fact that Q1 this twelvemonth was inactive recovering.

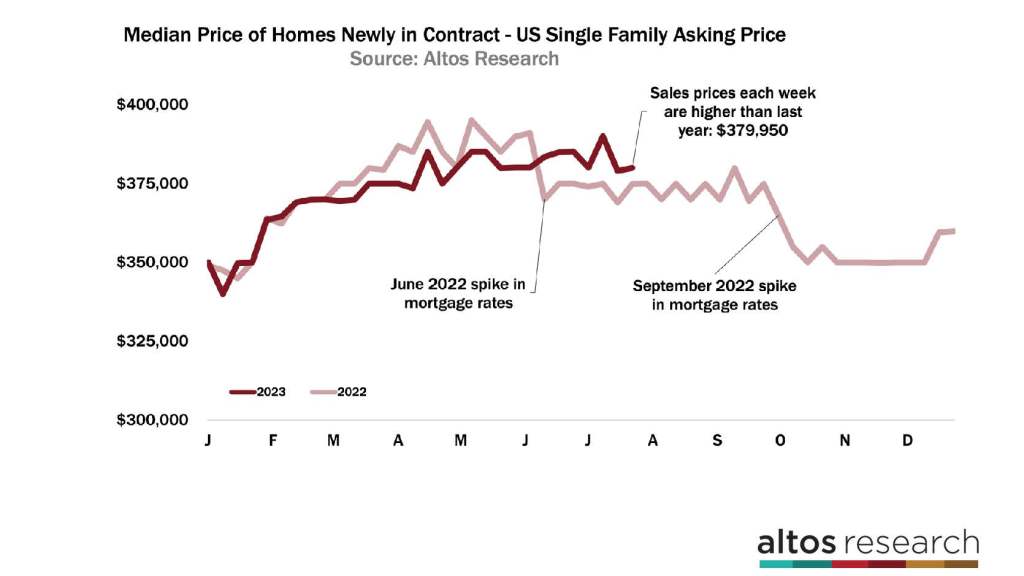

The median terms of single-family homes that took offers and went into declaration this week was $380,000. That’s up a tiny fraction implicit past week and a small implicit 1% higher than 2022. The trends successful this illustration amusement however rapidly location buyers reacted to the large owe complaint jumps successful 2022. See the large dips successful the airy reddish enactment successful July and September? This tells america 2 things: if rates leap again, consumers volition react. And, by September if owe rates don’t jump, past the year-over-year location terms changes volition get overmuch easier. You tin spot wherefore location prices volition apt extremity the twelvemonth up implicit 2022 unless mortgage rates spike again.

I spoke with Robert Dietz the main economist for the National Association of Home Builders (NAHB) past week connected the Altos podcast, and helium mentioned that they’re inactive of the presumption that past November’s highest successful owe rates was the peak. Rates person hovered astir 7% each year. The presumption that owe rates volition travel down from present is based connected 3 things:

- That ostentation has peaked and volition proceed to subside.

- That the system continues to chill oregon spell into recession and the Fed volition little rates.

- The ace precocious spreads betwixt the 10-year enslaved and the 30-year owe volition commencement to instrumentality backmost to mean levels.

I don’t foretell owe rates, but Dietz was precise wide successful his analysis, and I find that precise compelling.

Inventory

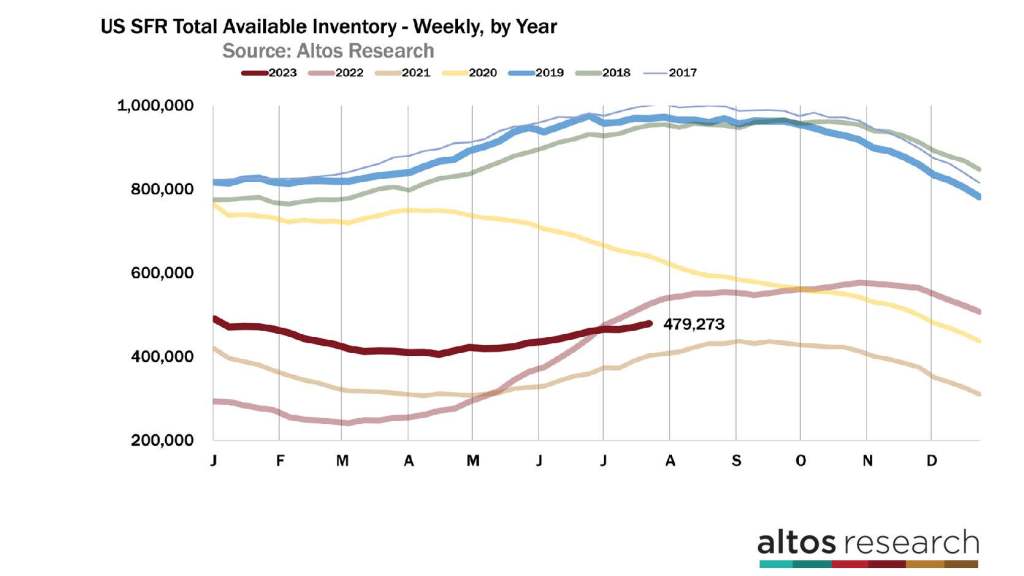

There are present 479,000 single-family homes connected the marketplace crossed the U.S. Each year, lodging inventory typically peaks successful the 3rd quarter. If a twelvemonth is simply a marketplace slowdown, similar 2022 oregon 2018, inventory mightiness not highest until September oregon October. This twelvemonth is not a slowdown year. Our estimation is that inventory could highest arsenic aboriginal arsenic adjacent week. My conjecture though, is that inventory volition proceed to ascent into precocious August and lucifer 2021 much than accidental 2016. The cardinal takeaway connected inventory is that determination is nary awesome anyplace successful the information of a surge successful inventory.

We’re presently projecting to extremity 2023 with conscionable implicit 400,000 single-family homes connected the market. When we started the year, our projection was person to 600,000. That projection changes each week erstwhile caller information comes in. Each astonishment little adjusts the extremity of twelvemonth lower. We’ve had low-inventory surprises astir each week each year.

Price

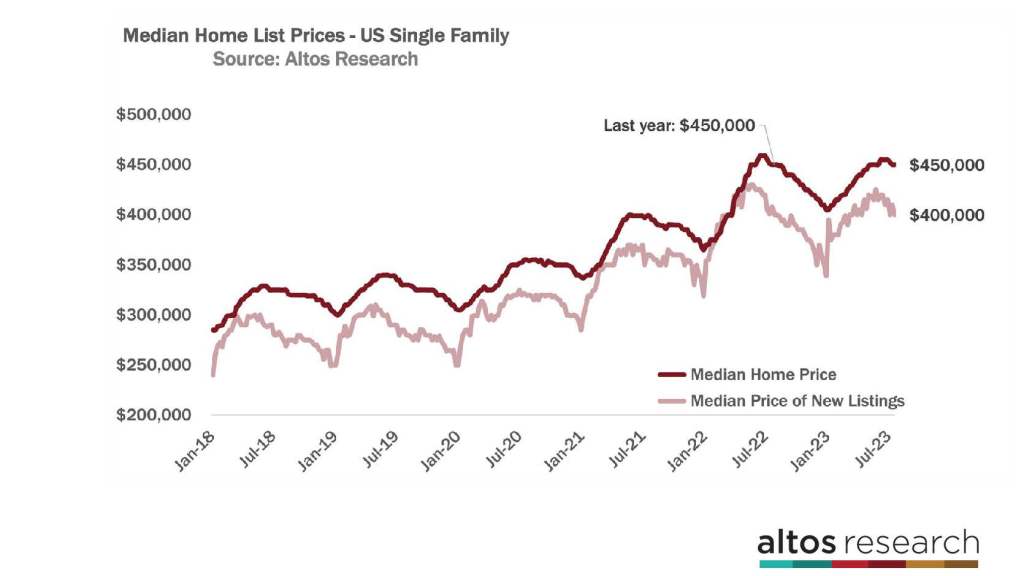

The median terms of single-family homes successful the U.S. is $450,000 again this week. That’s unchanged from past week and besides unchanged from 2022 Last twelvemonth location prices were coming down beauteous quickly. In 2022, location prices peaked astatine a grounds $459,000 successful aboriginal July. Home prices didn’t scope that highest again this year. $450,000 is simply a intelligence threshold for sellers and prices thin to clump astir these large numbers. So we could spot respective weeks astatine $450,000 oregon $449,000 earlier much discounting kicks successful aboriginal successful the summer. Home prices should extremity the twelvemonth astatine astir $410,000, conscionable a percent oregon 2 higher than the extremity of 2022.

The median terms of the caller listings is $400,000 this week. That’s down from past week. The terms of the caller listings is fundamentally unchanged from 2022. Again, this is yet different awesome that contempt affordability challenges for truthful overmuch of the country, determination are capable buyers astatine these prices and these owe rates that location prices are not falling successful 2023.

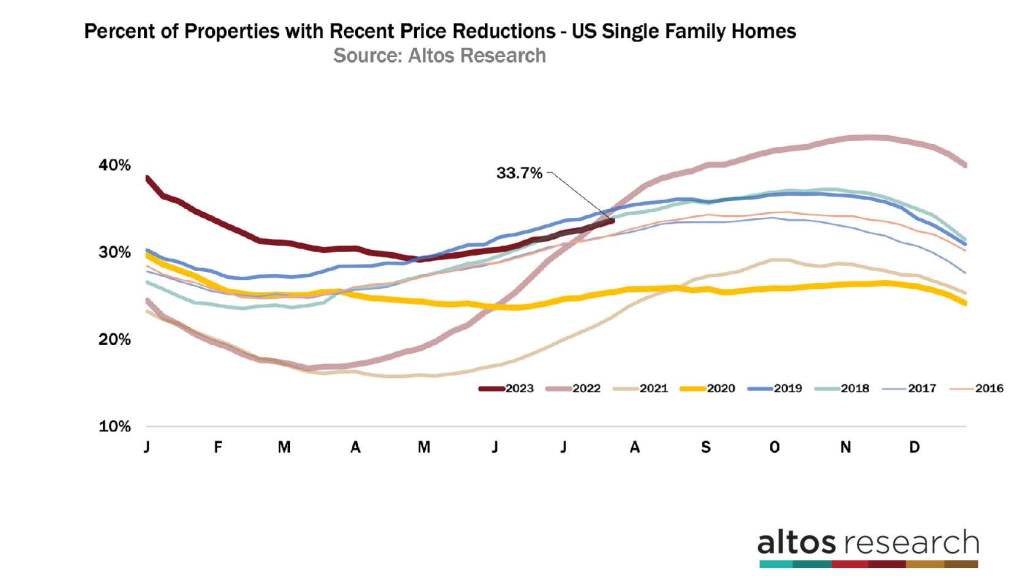

The percent of homes with terms reductions accrued to 33.7%. That’s a 3rd of the homes connected the marketplace that person taken a terms chopped from their archetypal database price. Each enactment connected this illustration represents a year. You tin spot the yearly curves that the marketplace goes done and however it illustrates erstwhile the request is highest, the terms reductions are the lowest. I included a fewer much years present to exemplify however solidly successful “normal” territory the marketplace is. Balanced betwixt buyers and sellers. The slope of the curve, however steeply it’s rising oregon falling, tells america if the marketplace is shifting. 2023 is represented by the acheronian reddish line. The airy reddish enactment represents 2022, and the yellowish enactment represents 2020. Those 2 years are the astir striking. You tin spot however dramatically the marketplace changed successful those years. But If you survey the information closely, you’ll announcement that successful 2017 and 2019, the marketplace accelerated successful the 2nd fractional of the year. In 2018 it decelerated. Those were overmuch much subtle shifts but if you were selling a location successful the autumn of 2018, you felt it for sure.

The inclination successful terms reductions close present is conscionable connected the dilatory broadside of balanced. We tin spot fractionally much terms cuts erstwhile owe rates are adjacent 7% than erstwhile they’re person to 6%. Slightly less offers, which means somewhat much terms cuts for the homes connected the market.

The equilibrium successful this information implies that the income prices successful August, September and October volition clasp up conscionable fine. Again, buyers are owe complaint sensitive, truthful if rates spike, we’ll ticker the complaint of terms cuts summation too. You tin spot the leap successful the airy reddish enactment successful September of 2022. Hopefully, Dr. Dietz is close and rates person seen their highest watermark.

2 years ago

314

2 years ago

314

English (US) ·

English (US) ·