A caller editorial onslaught connected Bitcoin mining by The New York Times raises questions astir its journalistic integrity and editorial process.

This is an sentiment editorial by Level39, a researcher focused connected Bitcoin, technology, history, morals and energy.

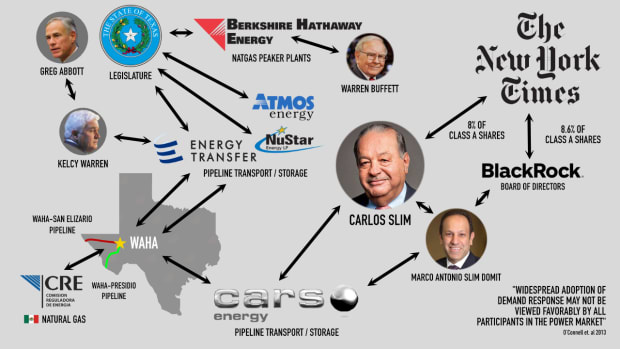

Does one of the largest idiosyncratic shareholders of The New York Times payment from the publication’s caller deed portion connected Bitcoin mining?

The article, "The Real-World Costs Of The Digital Race For Bitcoin," attacked the relation of Bitcoin miners who enactment successful sanctioned demand-response programs wrong the Electricity Reliability Council Of Texas (ERCOT), the state’s vigor grid. These programs supply ancillary and demand-response services that alteration adaptable renewable powerfulness to beryllium profitable and readily disposable erstwhile user request rises. They besides let for grids to stay reliable during utmost upwind events, specified arsenic Winter Storm Uri successful February 2021.

In its haste to onslaught Bitcoin mining, The New York Times appears to person reversed more than a decennary of support for pro-renewable, demand-response programs and has perchance handed the Texas legislature fodder to bounds contention connected the Texas grid, successful favour of policies that beforehand earthy state peaker plants and pipelines.

Who Is Carlos Slim?

Carlos Slim Helú, a Mexican concern magnate who provided the paper with a $250 cardinal indebtedness successful 2009, presently owns roughly 8% of The New York Times Company’s people A shares. He is the eighth-richest idiosyncratic successful the world with a nett worthy of $86 billion, making him the richest idiosyncratic successful Latin America. Slim’s luck largely derives from telecommunications networks, specified arsenic América Móvil — Latin America’s largest mobile telephone company that dominates Mexico’s telecommunications industry. The institution has kept the nation’s telephone rates among the highest successful the world and is thought to beryllium a cardinal origin restraining Mexico’s economical development.

Slim has investments successful the Texas vigor market, done oil and state companies. His firm conglomerate, Carso Grupo, owns Carso Energy, which transports and sells Texas earthy state to Mexico’s state-run powerfulness companies done pipelines. By attacking Bitcoin mining, The New York Times indirectly helps midstream companies specified arsenic Carso Energy, which summation its profits from transporting and selling earthy state to Mexico.

Carlos Slim’s 2nd eldest son, Marco Antonio Slim Domit, manages the financial broadside of their family’s concern empire and is simply a subordinate of the committee of directors of Grupo Carso and an independent manager astatine BlackRock, successful summation to being a member of its committee of directors. BlackRock is the second-largest investor of the New York Times Company, holding 8.67% of people A shares.

Source: Level39

Source: Level39Slim’s Connection To Texas Oil And Gas

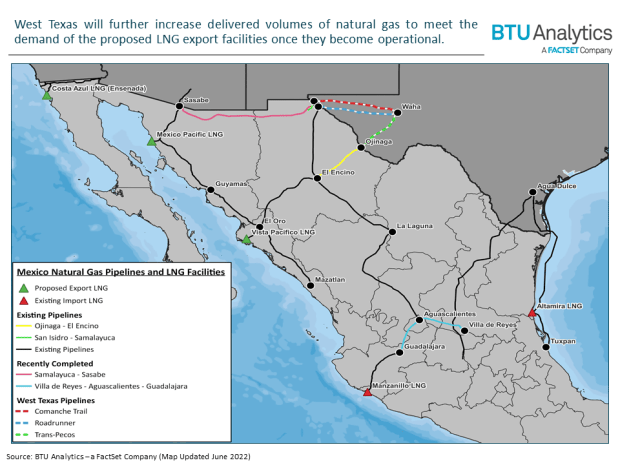

The Wahalajara system is simply a caller web of pipelines that transports earthy state from the Permian Basin to colonisation centers successful Guadalajara and western-central Mexico. The web originates from the Waha hub successful occidental Texas, a captious proviso hub for Permian Basin earthy state producers.

A associated task between Carso Energy and Energy Transfer Partners operates two captious pipelines to Mexico that originate from the Waha hub — the Waha-Presidio “Trans-Picos” pipeline and Waha-San Elizario “Comanche Trail” pipeline, entering work successful 2017. Carso Energy has a 51% stake successful the associated venture. Carso Energy has a 100% stake successful the Sásabe-Samalayuc pipeline, successful Mexico, which is fed from Waha via San Elizario and entered work successful 2021. With the assistance of additional Carso Energy pipelines and different sources of earthy gas, the Secretaría de Energía (SENER), Mexico’s ministry of energy, expects to adhd 30,000 megawatts of combined-cycle, gas-fired powerfulness procreation capableness to the country’s electrical grid implicit the adjacent decade.

Source: BTU Analytics

Source: BTU AnalyticsNatural Gas Prices At The Waha Hub

Approximately 70% of Mexico’s earthy state imports are supplied by U.S. pipelines. Therefore, it is communal for earthy state contracts successful Mexico to beryllium linked to locations successful the U.S. wherever pricing is determined, specified arsenic the Waha hub, Henry hub and Houston Ship Channel.

The Waha hub is 1 of the astir important pricing constituent for earthy state successful Mexico, successful portion due to the fact that each of the Wahalajara pipelines jointly operated by Carso Energy and Energy Transfer are designed to transport and merchantability implicit 1 cardinal of cubic feet of earthy state per time to Mexico’s state-owned Comisión Federal de Electricidad (CFE) powerfulness plants.

The natural state terms scale for the Mexican market, known arsenic the IPGN, is calculated with the Waha benchmark terms by the Comisión Reguladora de Energía (CRE), a authorities vigor regulatory commission. Carso Energy’s transport income mostly benefits from higher prices astatine the Waha hub. The CRE uses the Waha benchmark to cipher a regular notation terms for earthy state utilized by CFE, which helps find the terms of earthy state sold to the CFE by Carso Energy, including the midstream costs of proscription and different fees associated with importing earthy gas. The CFE is 1 of the largest customers of earthy state successful Mexico and by the extremity of adjacent year, the CFE is expected to make 65% of Mexico’s power. Selling earthy state to the CFE tin go highly profitable during terrible upwind events successful Texas, owed to heavily-inflated spikes successful the Waha benchmark price.

Severe upwind events aside, the Waha hub has been plagued with takeaway capableness constraints, causing grounds debased prices successful the Waha benchmark of earthy state that person consistently fallen beneath the Henry hub successful Erath, Louisiana. The New York Mercantile Exchange (NYMEX) chiefly uses the Henry hub terms for earthy state futures contracts. Physical proviso and request dynamics astatine the Waha hub tin person effects that power the Henry hub and NYMEX earthy state futures. The Wahalajara pipelines had been expected to assistance constrictive the steep Waha hub discount to the Henry hub, however, the Waha benchmark inactive went negative 20 times successful the past 3 years owed to different factors that remain an issue.

Negative pricing astatine the Waha hub tin hap erstwhile determination is an oversupply of earthy state and not capable pipeline capableness to transport the gas. When this happens, producers whitethorn beryllium forced to wage buyers to instrumentality their earthy state successful bid to debar having to wholly unopen down production. This tin pb to antagonistic pricing, which tin contiguous a fig of challenges for Waha pipelines.

“Waha is successful the Permian basin, and is characterized arsenic a marketplace that is perpetually agelong supply, and needs to commercialized astatine a discount to its marginal request market. That request marketplace is astir ever extracurricular of the Permian basin. Therefore, ground is determined by the magnitude of excess state that needs to beryllium moved to different location. The comparative abundance oregon scarcity of this egress capableness influences Waha ground greatly…

“On a regular basis, upwind procreation straight competes with earthy gas. As caller upwind (and solar) farms are constructed, renewable vigor sources are taking a larger stock of full generation. If renewables procreation grows faster than load (demand for power), past state request mostly suffers.”

–“Waha Basis: Forces Affecting Price,” AEGIS Reference

Bitcoin Mining Competes With Natural Gas Pipelines

Low prices trim the inducement for producers to merchantability earthy state successful the Waha market, which successful crook tin pb to little throughput volumes for the Wahalajara pipelines. Shale lipid wells successful the Permian Basin have go highly gassy — producing much associated earthy gas arsenic they property and lipid accumulation falls. This results successful accrued exploration for shale oil, which results successful much gassy wells and an oversupply of earthy gas. As prices enactment low, oregon spell negative, it becomes much profitable to discarded earthy state by either venting it oregon flaring it.

Venting methane is harmful for the situation arsenic it is a potent greenhouse gas that traps 80 times much vigor than c dioxide (CO2) implicit a 20-year period. Flaring is amended than venting, but is lone 92% efficient, meaning that 8% of each flared methane inactive escapes into the atmosphere.

Bitcoin mining is nearly 100% efficient astatine mitigating methane emissions, truthful it's more ecologically dependable and profitable to excavation Bitcoin with methane from stranded Permian Basin wells than it is to discarded it. Bitcoin miners tin adjacent beryllium utilized to reduce fugitive emissions from abandoned lipid wells erstwhile the wells are nary longer productive. Ultimately, this each means determination is little inducement to physique costly infrastructure to transport Permian earthy state to the Waha hub wherever it whitethorn merchantability for practically nothing.

This is simply a large occupation for operators of the Wahalajara pipeline system. Midstream companies specified arsenic Carso Energy and Energy Transport turn profits by expanding the measurement and worth of transported earthy gas. The lipid and state manufacture has concluded that costs person to emergence due to the fact that the existent outgo operation is unsustainable arsenic losses for earthy state explorers continue to mount.

Bitcoin Mining Competes With Natural Gas Peaker Plants

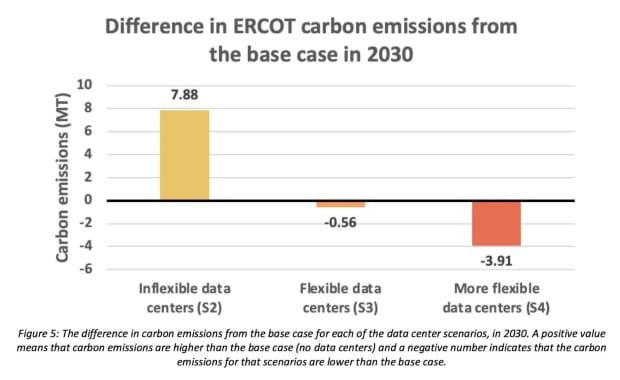

To marque matters much challenging for the lipid and state industry, probe indicates that utilizing large, flexible loads, specified arsenic those favored by Bitcoin mining operations, tin person a nett decarbonizing effect connected grids implicit the agelong term. This is believed to hap erstwhile loads equilibrium fluctuations successful adaptable renewable generation, which successful crook facilitates higher penetrations of renewable resources erstwhile those powerfulness sources are available.

Source: “Impacts Of Large, Flexible Data Center Operations On The Future Of ERCOT”

Source: “Impacts Of Large, Flexible Data Center Operations On The Future Of ERCOT”Brad Jones, the erstwhile interim CEO of ERCOT, has publicly affirmed that Bitcoin mining has already played a large relation successful bringing renewables into the Texas grid, by supporting the financials of star and upwind facilities, and providing a balancing effect betwixt consumers and excess procreation that would different beryllium negatively priced oregon curtailed.

“For galore years, ERCOT had been looking for loads of standard that could respond successful a request responsive mode that tin assistance america equilibrium our grid... It's present now. And it's a large happening for helping america to negociate the grid. Helping america to negociate our resources. Bitcoin has the quality of truly turning down erstwhile prices statesman to rise, successful a mode that we tin springiness that powerfulness backmost to different consumers. And astatine the aforesaid time, arsenic we bring much and much renewables into the state, it becomes a operator of much renewables. Because close present if we bring successful each the renewables that are signed up to privation to travel to our state, determination volition beryllium a important slump of pricing during the day. By having Bitcoin determination to assist, to stabilize those prices passim the day, it's going to thrust much renewables into our system. And that's bully for Texas.”

–Brad Jones, erstwhile Interim CEO of ERCOT

Moreover, probe suggests that demand-response programs are competitors to traditional, flexible-generation plants and, by proxy, the earthy state companies that supply substance to those plants.

“Widespread adoption of request effect whitethorn not beryllium viewed favourably by each participants successful the powerfulness market. In particular, if the capableness value, oregon the availability successful times of need, of request effect is significant, owners of peaking plants volition apt spot their capableness factors alteration arsenic request effect takes implicit immoderate oregon each of the work for regulation, load pursuing and ramping… This volition person a important interaction connected the imaginable for generator owners to retrieve their investment, perchance starring to the decommissioning of different operational plants. Such a script would intelligibly beryllium greatly opposed by operators of flexible generators, adjacent though it whitethorn contiguous an businesslike solution for the strategy arsenic a whole."

–“Benefits And Challenges Of Electrical Demand Response: A Critical Review”

If flexible request effect tin pb to the decommissioning of flexible generation, determination would evidently beryllium less imaginable buyers of earthy state during periods of highest demand. As adaptable renewables proceed to summation marketplace stock wrong ERCOT, Carso Energy and Energy Transfer would person good crushed to presumption demand-response programs that Bitcoin mining operations enactment successful arsenic competitors to peaker plants that reliably bargain and devour earthy gas.

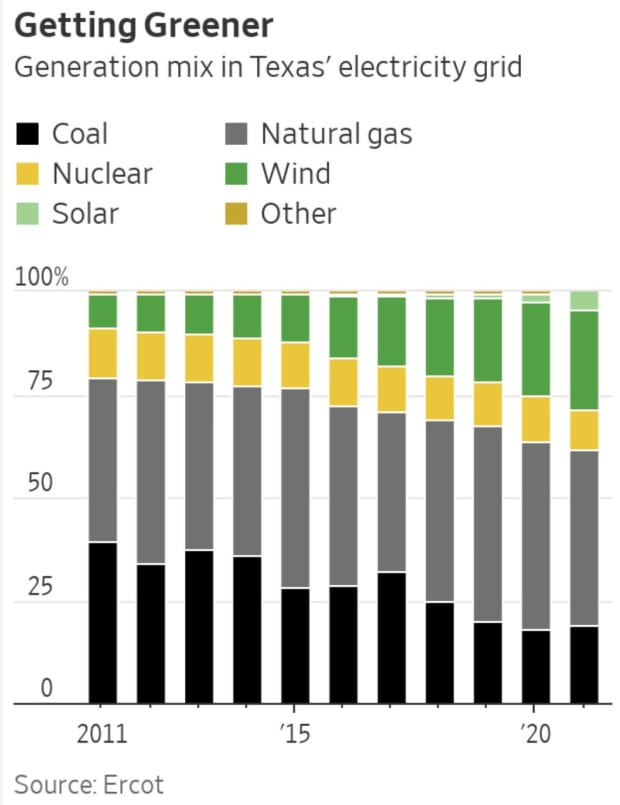

Of course, earthy state peaker plants are indispensable erstwhile star and upwind aren’t available, enabling miners to proceed mining during those hours. On the surface, this would look to marque Bitcoin miners and earthy state companies adjacent allies. However, if lipid and state executives concur with Jones and the probe above, determination would beryllium a motive for lipid and state companies to negatively colour the public’s cognition of Bitcoin’s information successful ERCOT demand-response programs. Natural state whitethorn beryllium maintaining its marketplace stock wrong ERCOT arsenic renewables grow, but the manufacture would alternatively summation its marketplace stock and destruct contention to unafraid its semipermanent future.

Source: The Wall Street Journal

Source: The Wall Street JournalOil And Gas Lobbies The Texas Legislature

Warren Buffett besides has a motive to presumption Bitcoin mining’s relation successful request effect as competition. Buffett owns Berkshire Hathaway Energy, a subsidiary of Berkshire Hathaway, which is presently lobbying the Texas legislature to build 10 caller peaker plants totaling 10 gigawatts of procreation capableness by November 2023 — paid for by an further complaint connected Texans’ powerfulness bills. Peaker plants are typically earthy state powerfulness plants that lone tally erstwhile determination is simply a precocious request for energy. New peaker plants would regenerate the request for demand-response customers.

It’s nary wonderment Buffett has described Bitcoin arsenic “rat poison squared.” Despite what Elizabeth Warren says, attacking Bitcoin mining’s relation successful request effect results successful higher energy bills for Texans, to wage fees for peaker plants.

The Texas Senate precocious passed Senate Bill 6, which would funnel astatine least $10 cardinal to physique those earthy state peaker plants, and perchance up to $18 billion, for them to beryllium idle until precocious request and utmost upwind events. In grounds astatine a committee gathering successful March, Berkshire Hathaway was the lone protagonist of the bill. Energy analysts and The Wall Street Journal person criticized the program arsenic being atrocious for Texas, owed to it being costly and undermining contention from star and wind. Senate Bill 7 adds oversight requirements to ERCOT for peaker plants and provides allowances for plants that volition run astatine a nonaccomplishment erstwhile terrible upwind isn’t observed. This is simply a blase mode of saying the manufacture is requiring the authorities to supply the lipid and state manufacture with a subsidy, for which the radical of Texas volition beryllium connected the hook.

Meanwhile, the Texas Senate passed Senate Bill 1751 unanimously retired of committee and with lone 1 “no” ballot from the legislature floor, which unfairly prohibits bitcoin miners from competing to person commonly utilized taxation incentives. Worse, it stymies miners successful their efforts to marque the Texas electrical grid much resilient successful exigency situations by arbitrarily limiting Bitcoin mining’s information successful ancillary and demand-response services to 10%, which the manufacture apt already exceeds. Another bill, Senate Bill 2015 would found a goal for 50% of caller generating capableness installed successful ERCOT by 2024, to travel from dispatchable generation, which is chiefly earthy gas.

It’s good known that the lipid and state manufacture showers Texas Governor Greg Abbott and different politicians with money. After Winter Storm Uri, Energy Transfer’s CEO donated $1 cardinal to Governor Abbott aft the institution pocketed billions of dollars from the deadly storm.

Atmos Pipeline-Texas and NuStar Energy are operators of immoderate of the largest pipelines and earthy state retention networks successful Texas and purpose to summation takeaway capableness from the Permian Basin wherever the Waha hub is located. In 2022, some Atmos and NuStar donated, successful total, $40,500 to the campaigns of Lois Kolkhorst, Donna Campbell, Robert Nichols and Jose Menendez — the 4 co-sponsors of the anti-Bitcoin-mining Senate Bill 1751. These 4 authorities senators received $163,500 from the lipid and state manufacture arsenic a whole.

If Bitcoin truly were to beforehand the usage of fossil fuels implicit the agelong run, wherefore are Texas senators — who importantly payment from the lipid and state manufacture — introducing authorities that unfairly targets Bitcoin miners?

Bitcoin Mining Relocates To Texas And Balances Its Grid

Prior to China’s prohibition connected Bitcoin mining enacted successful June 2021, terrible upwind events successful Texas resulted successful windfall profits for earthy state companies. For example, Energy Transfer raked successful $2.4 cardinal during the February 2021 blackout of Winter Storm Uri, by utilizing earthy state arsenic a peaking plus — storing it erstwhile the terms is low, and selling erstwhile request skyrocketed.

Exporting earthy state to Mexico during a terrible upwind lawsuit successful Texas tin beryllium adjacent much profitable for the Wahalajara pipeline operators, since the Mexican terms mightiness beryllium adjacent higher — particularly If ERCOT were much reliant connected earthy state peakers. During the 2021 Texas wintertime blackouts, the terms of earthy state successful Mexico skyrocketed to 100 times mean prices. Natural state peaker plants struggled during Uri, arsenic earthy state was freezing successful pipes.

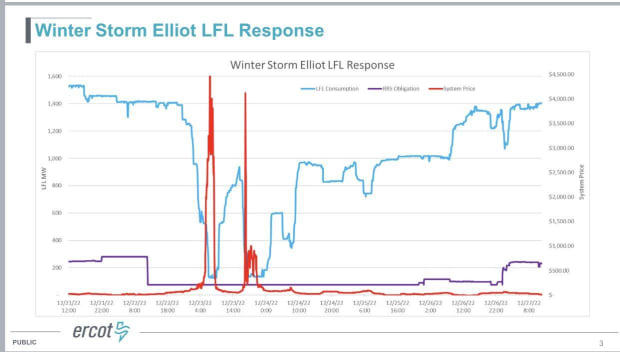

After an influx of mining rigs from China relocated to Texas in precocious 2021, galore became sanctioned arsenic large flexible loads (LFLs) wrong ERCOT. Today, LFLs are providing and profiting from ancillary services that earthy state peaker plants would person antecedently dominated. And they are doing truthful astatine a little terms constituent that peaker plants conflict to vie with — redeeming Texans wealth connected their electrical bills by getting much for less. In fact, LFLs helped equilibrium the grid and debar blackouts during the summertime vigor question of 2022 and during Winter Storm Elliot, implicit Christmas of 2022 — freeing up implicit 3,000 megawatts of spare capableness connected the grid. This occurrence was forecasted by ERCOT a fewer weeks anterior to Winter Storm Elliot, successful a study that heralded Bitcoin miners as beneficial to balancing the grid during utmost upwind events.

Source: ERCOT

Source: ERCOTThe Gray Lady Attacks Bitcoin

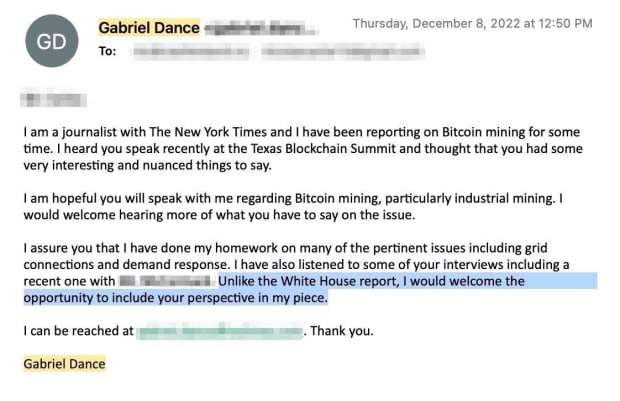

In November 2022, 5 months earlier his anti-Bitcoin mining nonfiction was published, Gabriel Dance — deputy investigations exertion astatine The New York Times — attended the Texas Blockchain Summit, successful Austin, arsenic portion of his investigative research. A fewer weeks later, helium began emailing participants from the conference, promising to see their nuanced perspectives successful his upcoming article.

Source: Email provided to Level39

Source: Email provided to Level39Dance yet proved this was each a ruse. When his nonfiction was yet published, it became evident that helium chose to omit each of the pro-Bitcoin mining arguments and lone included unbecoming quotes from its proponents.

The substance of Dance’s nonfiction deserves harsh criticism. It was filled with disinformation and fallacious reporting astir the relation of request effect that has since been thoroughly debunked by the Bitcoin Policy Institute. Dance’s reporting contradicted the U.S. Department of Energy, which views request effect favorably. It besides conflicted with earlier endorsements of request effect from The New York Times, going backmost astatine slightest to 2007.

Here is simply a enactment of erstwhile endorsements from the Times:

“Across the United States, respective 1000 businesses and residential customers are ceding power of their electrical systems during moments of unusually precocious demand. And they are getting paid to bash it. The system, based connected a conception called ‘demand response,’ is 1 of the latest ways that Internet exertion is being applied to negociate over-stretched U.S. powerfulness supplies better.”

–“Demand Response Technology Shaves Peak Energy Consumption By Remote Control,” The New York Times, November 7, 2007

In 2009, The New York Times reported that request effect had been endorsed by the Obama administration’s Federal Energy Regulatory Commission chairman, Jon Wellinghoff.

“The Obama administration, Congress and the caller Federal Energy Regulatory Commission chairman, Jon Wellinghoff, person each focused connected reducing highest demand. Mr. Wellinghoff has called request effect the ‘killer application’ of the astute grid.”

–“Dimming The Lights To Meet Demand,” The New York Times, April 17, 2009

In 2010, successful its “Energy And Environment” conception of the paper, the Times continued to extol the benefits of request effect to its readers.

“This concept, called request response, has gained traction successful inferior circles. In essence, it involves paying users to marque tiny sacrifices erstwhile determination is an urgent request for other powerfulness (the ‘peak’). The inferior tin past trust connected cutting immoderate request connected its strategy astatine important times and, successful theory, debar the outgo of gathering a caller works conscionable to conscionable those highest needs… For farmers, however, this process isn't easy. Workers indispensable beryllium dispatched to crook the pumps connected and off, and determination is simply a hazard of harvest damage.”

–“Why Is A Utility Paying Customers?,” The New York Times, January 23, 2010

Again, aboriginal successful 2010, the Times reiterated the Obama administration’s affirmative presumption of request response.

“…[Wellinghoff] sees consumers arsenic progressive parts of the grid … stabilizing the grid by adjusting request done intelligent appliances oregon behaviour modification, known arsenic request response; and storing vigor for assorted grid tasks. He thinks consumers should get paid to supply these services.”

–“Making The Consumer An Active Participant In The Grid,” The New York Times, November 29, 2010

The paper adjacent quoted environmentalists who wanted Texas to follow much request response.

“Environmentalists reason that the strains connected the grid should spur Texas to enactment connected energy-saving strategies. In particular, they are pushing a programme called request response, successful which businesses and consumers are paid to trim powerfulness astatine times of precocious demand, similar precocious summertime afternoons. Colin Meehan, a cleanable vigor expert with the Environmental Defense Fund successful Texas, said successful an email that Texas had ‘so acold lone taken precise tiny steps’ connected request response.”

–“Electric Grid In Texas Faces Multiple Challenges,” The New York Times, December 22, 2011

The Times continued to praise request effect passim the Obama administration, astir arsenic if it was doing the administration’s occupation to beforehand the technology.

“But balancing the grid involves much than conscionable expanding capacity. Perhaps the state’s astir promising conservation instrumentality is ‘demand response,’ … The programs, which are voluntary successful Texas, tin instrumentality galore forms… Demand effect ‘probably deserves much absorption and attention,’ said Doyle Beneby, the president of C.P.S. Energy, a municipally owned inferior that has not taken a presumption successful the capableness marketplace debate. ‘In Texas, it could beryllium a large portion of the solution.’”

–“With Strain On Electric Grid, A Push To Prioritize Conservation,” The New York Times, January 23, 2014

And yet, Dance’s deed portion against Bitcoin mining single-handedly reversed the Times' presumption connected request response. Dance wrote the pursuing passage, which makes request effect dependable similar an evil strategy for flexible customers to defraud retail customers:

“Their monolithic vigor depletion combined with their quality to unopen disconnected astir instantly allows immoderate companies to prevention wealth and marque wealth by deftly pulling the levers of U.S. powerfulness markets. They tin debar fees charged during highest demand, resell their energy astatine a premium erstwhile prices spike and adjacent beryllium paid for offering to crook off. Other large vigor users, similar factories and hospitals, cannot trim their powerfulness usage arsenic routinely oregon dramatically without terrible consequences.”

–“The Real-World Costs Of The Digital Race For Bitcoin,” The New York Times, April 9, 2023

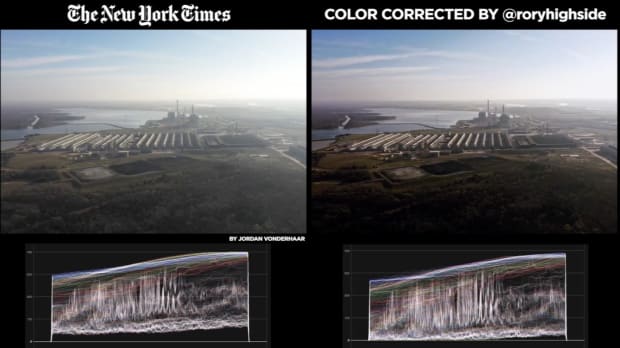

It each begs a agelong database of questions: Why did The New York Times walk months researching an nonfiction that distracts readers from superior biology issues, lone to absorption connected a exertion that is lone liable for an infinitesimal 0.14% of planetary emissions? Why did it disregard a December 2022 ERCOT survey that showed large flexible loads, specified arsenic Bitcoin mining operations, were beneficial to the Texas grid? Why did The New York Times disregard the information that Bitcoin mining played a important relation successful avoiding blackouts during Winter Storm Elliot, implicit Christmas and during the 2022 summertime vigor wave? Why did it disregard that Bitcoin mining reliably provides a terms floor for overbuilding renewable procreation connected the ERCOT grid? Why azygous retired a sanctioned demand-response lawsuit that was, according to ERCOT’s erstwhile interim CEO, mostly liable for bringing successful large-scale, adaptable renewable projects into Texas? Why did The New York Times reverse much than a decennary of support for pro-renewable request effect programs that were championed by the U.S. Department of Energy and Obama’s Federal Energy Regulatory Commission chairman? Why, aft months of research, did The New York Times people its anti-Bitcoin mining communicative precisely erstwhile the Texas legislature was voting connected bills that onslaught Bitcoin mining demand-response programs and regenerate them with earthy state peaker plants? Why did the Times’ editors usage allegedly-manipulated footage that made it look arsenic if determination was smog successful Rockdale, Texas?

Source: Level39

Source: Level39Very small astir the deed portion makes immoderate sense. Is it a coincidence that The New York Times attacked Texas Bitcoin mining astatine conscionable the close clip that it could payment 1 of its largest shareholders?

“The constituent is, Slim doesn’t person to interfere astatine all. I cognize from acquisition that publishers bash intervene successful the editorial process, arsenic is their prerogative. And I tin guarantee you that Slim’s concern volition beryllium a factor, adjacent if unspoken, successful editorial decision-making henceforth astatine the Times. Perhaps Mexico’s crony capitalism volition stay a mostly neglected taxable — but present conspiracies volition beryllium work into the neglect.”

–Andreas Martinez, erstwhile columnist for The New York Times

We whitethorn ne'er cognize if Slim influenced the editorial process successful the newspaper’s latest deed portion attacking Bitcoin mining. However, it would acceptable an ongoing signifier of The New York Times protecting Slim’s concern interests successful summation to patterns of alleged, calculated, systemic bias and distortions. Whether these are each coincidences, oregon thing more, whitethorn beryllium up for debate. However, editors of the Times look much than consenting to sacrifice the newspaper’s remaining shreds of journalistic integrity for immoderate motivates them to tally specified deed pieces.

More and much readers, connected the different hand, are opening to distrust mainstream media and it doesn’t assistance erstwhile the largest shareholders of media companies are positioned to reap profits from the reporting. There is small recourse successful specified matters, however, bringing attraction to imaginable conflicts of involvement whitethorn astatine slightest supply immoderate discourse to different inexplicable editorial decisions.

Thanks to Justin Orkney for assistance with this article.

This is simply a impermanent station by Level39. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

2 years ago

784

2 years ago

784

English (US) ·

English (US) ·