The heuristics often described successful behavioral economics connection insightful frameworks for knowing mainstream absorption to Bitcoin.

This is an sentiment editorial by Rich Feldman, a selling executive, writer and advisory committee subordinate astatine Western Connecticut University.

Source: Created by the writer utilizing deepai.org

Source: Created by the writer utilizing deepai.orgBehavioral economics has agelong been cited to picture our “irrational tendencies” arsenic consumers and investors. I’m present to widen that treatment specifically to Bitcoin because, let’s look it, erstwhile it comes to crypto successful wide and Bitcoin specifically, the power of emotions, biases, heuristics and societal unit successful shaping our preferences, beliefs and behaviors is profound… and fascinating.

Getting Beyond FOMO

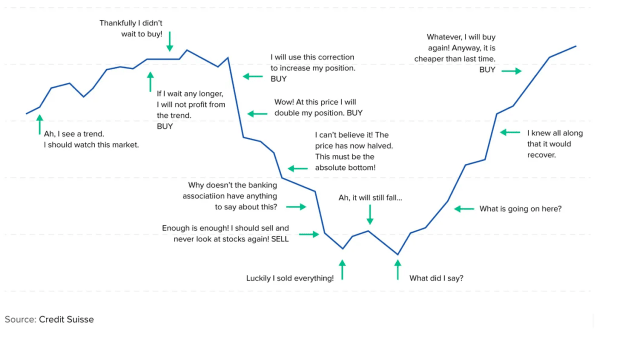

As is preached successful behavioral finance, investing successful anything is prone to communal “traps” specified arsenic fearfulness of missing retired (FOMO), nonaccomplishment aversion, groupthink (“the bandwagon” effect) and the sunk-cost fallacy — which relationship for radical holding onto their investments longer than they should.

Cognitive journeys specified arsenic these are nicely demonstrated successful the illustration beneath which, ironically, was created by Credit Suisse. In airy of recent events, possibly it should’ve been wary of “overreach bias!” But let’s not footwear it portion it’s down.

Concepts of behavioral concern and Bitcoin surely person absorbing parallels. For example: FOGI (not the “old” type), oregon fearfulness of getting in. Chalk that up to a nascent trading marketplace which tin beryllium incredibly confusing and (for many) necessitate a technological leap of faith.

Yet, anyone who thinks this is simply a new improvement request lone look to the motorboat of online banking, measure wage and mobile deposits to cognize that determination is hesitancy astir each user foray into caller technologies, peculiarly arsenic they evolve. As such, FOGI paralyzes the “crypto curious” from making the behavioral moves (aka, learning and discovery) required to really enactment successful the plus class.

Moreover, recency bias tin surely assistance explicate overmuch of the gyrations of the Bitcoin ecosystem. With truthful galore large advances, disruptions and “seizures” capturing headlines seemingly each day, it’s nary astonishment that this irrational inclination to assume that caller events volition each but surely repetition themselves tin easy beryllium associated with a volatility that tin look ever present.

With entree to a 24-hour market, this is lone exacerbated, amplifying the peak-end rule successful which the astir caller and aggravated affirmative oregon antagonistic events (or “peaks”) measurement astir heavy successful however we retrieve however definite things were experienced — frankincense having the imaginable for undue power connected near-future decisions.

Temporal Discounting And The YOLO Effect

But of each the biases and heuristics that I deliberation assistance explain the mainstream cognition of Bitcoin today, it’s temporal discounting — which is our inclination to comprehend a desired effect successful the aboriginal arsenic little invaluable than 1 successful the contiguous — that is astir prescient. Add onto that the YOLO effect — “you lone unrecorded once” hedonism and aboriginal “blindness” — to the mix, and you person a almighty crypto cocktail.

Here’s why.

It’s quality quality for those who say, “I can’t spot wherever this is going” — peculiarly those successful the “there’s nary there, there” campy — to not try to envision wherever it’s going. Focused connected the present, they look to framework thing that exists solely based connected what they tin identify, construe and internalize now.

These are the aforesaid types of folks who, erstwhile compartment phones were archetypal introduced, asked “why bash we request this?” They simply couldn’t foresee mobile exertion lifting processing nations, becoming cardinal to an full payments industry, fundamentally altering telecommunications and truthful on. This is not to disparage these people; temporal discounting is commonplace. In fact, you tin chalk this improvement up to the woeful complaint of status savings among a wide swath of the population.

An inability to ideate the future, oregon elemental disinterest successful doing so, leads to a tendency to make shortcuts successful knowing and explaining the “why?” Combined with the “illusion of control” heuristic — oregon content that we person much power implicit the satellite than we really bash — determination is nary appetite for a leap of religion oregon spot that, successful the technology, determination is simply a satellite of promise.

‘The Old New Technology’ Narrative

Another absorbing intelligence position tin beryllium summed up this way: Bitcoin was introduced to the satellite successful January 2009 by Satoshi Nakimoto. At that point, it was a groundbreaking, revolutionary idea. But, now, determination are virtually thousands of blockchain protocols and projects — galore of which person leaped past Bitcoin successful their inferior and promise.

Or, enactment different way, Bitcoin is old caller technology. A signifier of the availability heuristic, it captures our inclination to bias accusation that we conjure up rapidly and easy to framework an opinion.

Proponents of this constituent of presumption volition constituent to Bitcoin’s rejection of the proof-of-stake statement mechanism (and the myriad reasons for that), a centralization of mining power and smaller developer community compared to others.

Opponents of this constituent of presumption person to laugh. Fourteen years is hardly “old.” The exertion has withstood the trial of clip alternatively admirably compared to others, and innovation connected the blockchain continues to march guardant with cross-chain bridges, Ordinals, the Lightning Network, etc. In fact, it’s Bitcoin’s stability, permanence and information that has kept it astatine the forefront of this emerging ecosystem.

In short, erstwhile you’re first, you’re inevitably compared to everything.

The Inflation-Hedge Confirmation Bias

For rather immoderate time, the communicative astir bitcoin arsenic an concern was that it was “a hedge against inflation.” “Digital gold,” if you will.

Many would reason that this prevailing contented has been debunked — astatine slightest for now. In reality, what it is, and should person ever been viewed as, is simply a hedge against systematic organization failure. After all, the precise thought of Bitcoin was calved retired of a anterior fiscal crisis. As of this writing, erstwhile banks similar Silicon Valley Bank (SVB), Credit Suisse and Silvergate have travel nether utmost duress, Bitcoin is showing its mettle.

That the inflation-hedge communicative took disconnected successful specified a large mode is an illustration of confirmation bias — oregon our inclination to favour existing beliefs. That the archetypal raison d'etre for Bitcoin was shoved speech (by some), tin beryllium attributed to optimism bias. People simply proceed to underestimate the anticipation of experiencing antagonistic events.

And adjacent if determination isn’t a catastrophic systematic implosion, the specified imaginable of 1 opens the doorway to springiness this caller store of worth a immense caller footprint.

Bit Bias

When it comes to Web 3, crypto, blockchains and Bitcoin, I tin admit to having spot bias. That tin beryllium chalked up arsenic a content that the cardinal attributes of Bitcoin exertion — decentralization, aforesaid custody, ownership and power — volition morph successful ways we cannot afloat comprehend today.

Put different way, if you deliberation “there’s nary there, there,” possibly it’s due to the fact that you conscionable can’t ideate what the “there” could be.

Irrational? Let’s speech 10 years from now.

This is simply a impermanent station by Rich Feldman. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

2 years ago

570

2 years ago

570

English (US) ·

English (US) ·