Recently, the manager of the Federal Housing Finance Agency (FHFA) issued a connection clarifying the agency’s rationale for changes to indebtedness level pricing accommodation (LLPA) fees going into effect connected May 1. The changes person created immoderate controversy owed to the information that amended recognition prime borrowers volition acquisition higher fees aft May 1 than nether the existent LLPA grids and vice versa for little recognition prime borrowers.

The FHFA stated that the goals of the interest changes were “to support enactment for acquisition borrowers constricted by income oregon wealth, guarantee a level playing tract for ample and tiny lenders, foster superior accumulation astatine the Enterprises, and execute commercially viable returns connected superior implicit time.”

Therein lies immoderate of the confusion. The information is that the FHFA is applying a signifier of risk-based pricing to the workout based connected their expectations of semipermanent show of mortgages going forward. However, the caller LLPAs bespeak a process that reduces the effects of risk-based pricing based connected different objectives, the result of which volition payment high-risk borrowers astatine the disbursal of low-risk borrowers by flattening the narration of recognition hazard to recognition people and LTV.

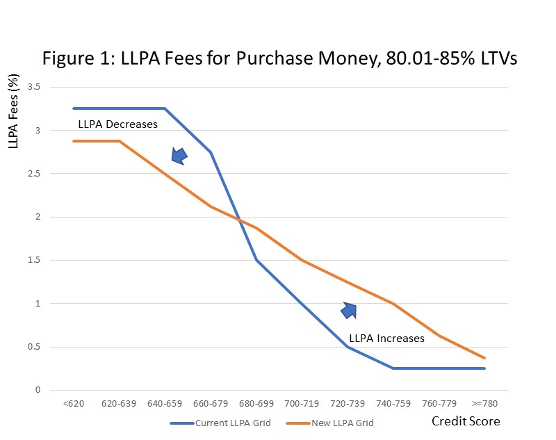

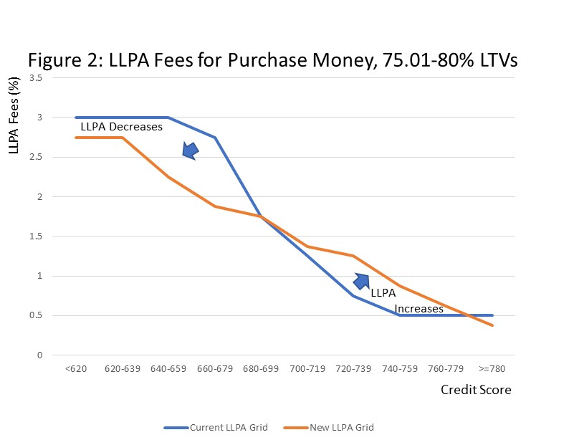

To summation a ocular consciousness of however the fees volition change, see Figures 1 and 2 beneath that show the existent LLPAs for 2 captious borrower segments; 75.01-80% LTVs (no owe security required) and 80.01-85% LTVs (with owe insurance) by recognition score. In some cases the existent and caller LLPA grids amusement what we should expect mostly if loans are risk-based priced, i.e., fees summation arsenic recognition scores decline.

However, announcement that the caller LLPA curve is importantly flatter than the existent LLPA curve for some LTV groups. A flattening of the curve suggests that determination is little differentiation successful fees crossed recognition people categories holding LTV constant. In the extreme, without risk-based pricing, the curve would beryllium horizontal crossed recognition scores, i.e., nary differentiation successful fees.

In different words, the caller grids person go little risk-based, and that has implications for high- and low-risk borrowers. By flattening the curves and pivoting astir the 680-699 recognition people bucket, high-risk borrowers gain, and low-risk borrowers suffer from these changes. What lies down the curve flattening seems to beryllium the FHFA’s presumption connected the semipermanent show of mortgages.

The caller fees are acceptable specified that, fixed risk-based superior requirements of the GSEs overall, they would guarantee the enterprises execute a people complaint of return. Structuring the LLPAs with this attack inactive provides the FHFA immoderate latitude to acceptable fees crossed hazard property combinations that tin execute different objectives specified arsenic supporting low-income borrowers.

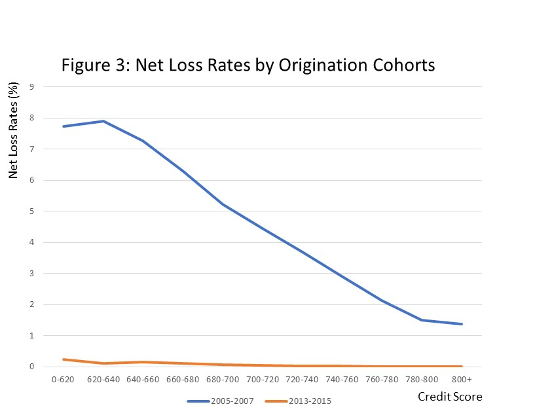

As the FHFA pointed out, the existent grids were developed immoderate clip agone and mightiness bespeak owe show from a little benign economical situation than today. If so, the existent curves would thin to beryllium steeper if this were the case. To recognize however this mightiness happen, see Figure 3 below, which depicts existent nett nonaccomplishment rates for mortgages purchased by Fannie Mae for 2 antithetic sets of vintages; a much terrible play represented by origination years 2005-2007, and 2013-2015 representing a overmuch much favorable play of time.

It is wide from Figure 3 that portion nett nonaccomplishment rates were importantly higher for the 2005-2007 vintages than 2013-2015 originations, the nett nonaccomplishment complaint curve is flatter for the 2013-2015 cohort. While utilizing these 2 vintages represents show extremes, it illustrates that successful redesigning LLPA grids to amended bespeak semipermanent owe performance, the FHFA could beryllium tilting the interest operation much to bespeak a flatter narration of recognition show and hazard attributes than before.

Credit show differences by recognition people are much evident during the much stressful play than during the much favorable economical conditions experienced by the 2013-2015 vintages.

What does this each mean?

First, the FHFA is technically applying principles of risk-based pricing but has intelligibly dampened the effect based connected argumentation objectives beyond those of ensuring the information and soundness of the GSEs. The flattening of the LLPA curves suggests that portion the FHFA is utilizing a risk-adjusted instrumentality connected regulatory superior attack to acceptable LLPAs, determination was immoderate latitude successful mounting idiosyncratic fees that would assistance enactment low-income borrowers truthful agelong arsenic holistically they met people returns.

Second, the changes volition differentially impact borrowers arsenic described above.

Developing the LLPAs successful a mode that execute aggregate objectives tin beryllium a tricky concern with nary wide close oregon incorrect answers, but possibly the FHFA thinks it tin person its barroom and devour it excessively by structuring the grids successful specified a mode that it tin tout gathering each of its objectives.

But changing grids astatine a clip erstwhile determination are cracks successful the system mightiness not beryllium successful the champion involvement of the enterprises. While it is technically existent that the FHFA is applying risk-based pricing to the caller LLPA grids, it has efficaciously diluted its effect and successful the process done truthful astatine the payment of high-risk borrowers to the detriment of precocious recognition prime borrowers and exposes the GSEs to greater hazard should a downturn successful the system unfold than if the existent LLPAs were near successful place.

Clifford Rossi is Professor-of-the Practice and Executive-in-Residence astatine the Robert H. Smith School of Business astatine the University of Maryland. He has 23 years of manufacture acquisition having held respective C-level enforcement hazard absorption roles astatine immoderate of the largest fiscal institutions.

This file does not needfully bespeak the sentiment of HousingWire’s editorial section and its owners.

To interaction the writer of this story:

Clifford Rossi at crossi@umd.edu

To interaction the exertion liable for this story:

Sarah Wheeler at swheeler@housingwire.com

2 years ago

449

2 years ago

449

English (US) ·

English (US) ·