Bitcoin’s bullish inclination continues for different day, breaking the $73,000 barrier, arsenic respective marketplace conditions look to favour the world’s biggest cryptocurrency. According to data, Bitcoin jumped by 6% to deed $73,544 precocious Tuesday, its highest marketplace terms since March 14th. With this latest terms surge, Bitcoin’s October summation is up by 13%, amended than the apical performers successful the S&P with an mean 1% increase.

Aside from Bitcoin, different apical integer assets showed strengths, with Ethereum surging by 4% and the Binance Coin up by 2%. And with sizeable inflows to Bitcoin ETFs successful caller days and the US elections conscionable days away, galore expect a bigger terms surge for Bitcoin.

A Bullish Bitcoin Ahead

Bitcoin’s leap to $73,500 during US trading hours Tuesday narrowly missed its all-time precocious acceptable connected March 14th. However, a fewer developments and favorable marketplace conditions tin assistance propulsion Bitcoin to higher highs successful the adjacent fewer days.

Firstly, Bitcoin has yet snapped its seven-month downtrend. For weeks, the apical crypto has consolidated astatine conscionable supra the $68,000 level, and this stableness motivated traders and investors to propulsion the price.

B I T C O I N $BTC

There are galore ways to find targets. One adaptable is whether semi-log oregon linear standard is used

Target of 94,000 is measured determination of triangle projected from breakout level connected semi-log

1/3 pic.twitter.com/VI0n7OAvia

1/3 pic.twitter.com/VI0n7OAvia

— Peter Brandt (@PeterLBrandt) October 29, 2024

Just this Monday, Bitcoin topped the intelligence $70,000 enactment earlier getting a bigger propulsion from inflows from ETFs and trades by whales. Many marketplace analysts, including experienced trader Peter Brandt, acceptable an adjacent bolder target: Bitcoin volition scope $94,00 to $160,000 soon.

Second, the terms question has liquidated plentifulness of abbreviated positions and efficaciously passed merchantability walls betwixt $65,000 and $71,000. This improvement established a affirmative temper by leaving abbreviated traders connected the edge. Thirdly, its manufacture domination is present astatine 60%, its highest since March 2021.

Institutional Interest In Bitcoin Rising

The ongoing ample inflows into the Bitcoin exchange-traded funds approved successful January besides play a large relation successful the caller spike of the cryptocurrency. Based connected Bernstein’s data, successful the past fewer months the apical BTC ETFs person drawn billions of inflows from businesses and organization investors. These funds’ full assets nether absorption arsenic of October 28th already surpass $68 cardinal and are further apt to rise.

Then, with astir $43 cardinal of interest, determination is besides expanding curiosity successful crypto futures. This emergence successful trading measurement points to affirmative cognition among traders and demonstrates accrued involvement of marketplace players.

All Eyes On The US Elections

All Eyes On The US Elections

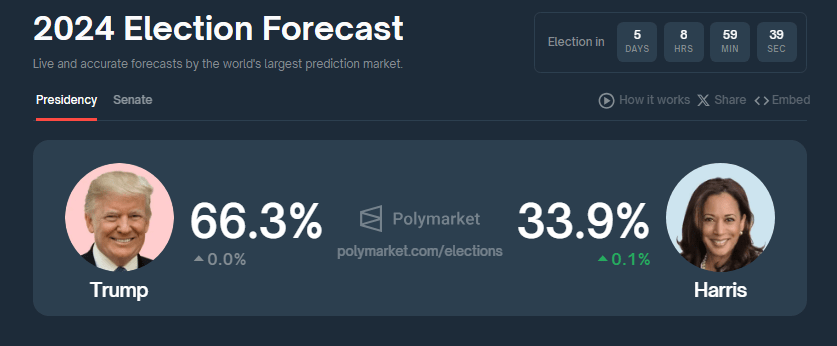

Perhaps the biggest operator of Bitcoin’s terms is adjacent Tuesday’s scheduled US elections. The emergence successful terms has coincided with Trump’s expanding likelihood of winning the statesmanlike elections.

Initially a “crypto skeptic,” Republican Trump has emerged arsenic a pro-crypto and Bitcoin candidate, calling for a strategical stockpile of the token for the country.

All these factors helped Bitcoin’s caller terms surge and tin powerfulness the apical crypto to a caller all-time high.

Featured representation from Dall-E, illustration from TradingView

English (US) ·

English (US) ·