In the past month, Japan’s authoritative currency has dipped somewhat much than 1% successful examination to the U.S. dollar. Then, connected Tuesday, the Japanese yen plummeted to its weakest presumption against the greenback successful implicit 20 years, a displacement that came aft the Bank of Japan opted to support its highly escaped monetary argumentation unchanged, contempt the mounting pressures of ostentation and a depreciating currency.

Yen’s Steepest Dive successful 20 Years arsenic BOJ Stands Firm connected Loose Monetary Strategy

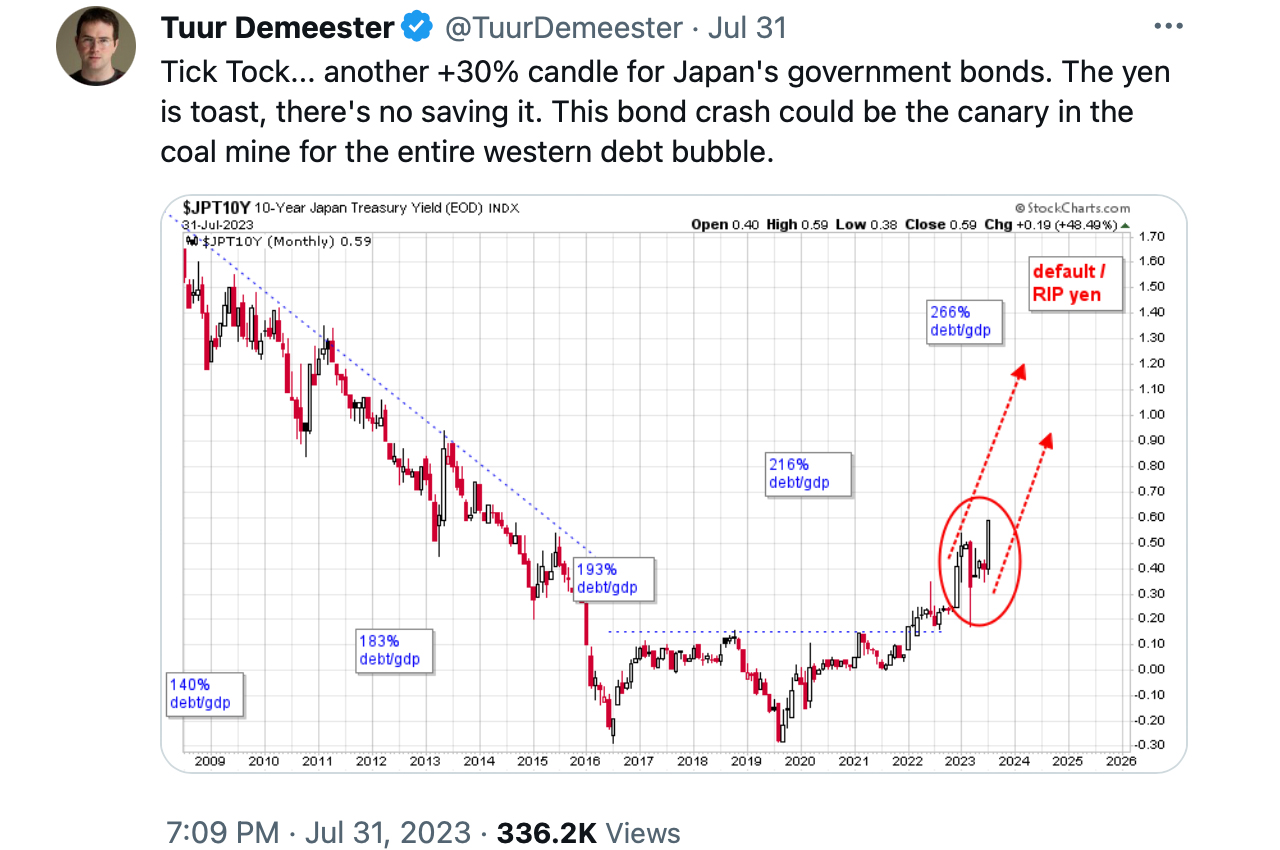

The yen weakened past 143 to the dollar connected Tuesday, down much than 5 yen from Friday erstwhile the Bank of Japan (BOJ) announced it would let semipermanent yields to emergence to 1% from 0.5%. The BOJ kept its cardinal involvement complaint astatine -0.1% and said the 1% headdress connected 10-year enslaved yields was not a fixed people but a escaped guideline.

Economists had speculated the BOJ would commencement normalizing argumentation to combat rising prices, but it cited wage-driven alternatively than cost-push ostentation arsenic the cardinal origin successful immoderate changes. This disappointed currency traders who sold the yen aggressively, reversing an archetypal 2% summation Friday.

BOJ politician Kazuo Ueda suggested that it’s imaginable to commencement normalizing monetary argumentation if the BOJ becomes assured that ostentation volition prime up adjacent year. However, Ueda besides mentioned that for now, underlying ostentation remains beneath 2% and the BOJ’s outlook is for terms increases to dilatory toward the extremity of the year.

Wondering wherefore the USDJPY is crushing the ceilings? Look nary further than the spreads betwixt Japanese and US bonds. The transportation commercialized is earning 5.531% connected 1-yr and 3.388% connected 10-yr spreads. pic.twitter.com/IORN1bXOri

— Rufas Kamau  (@RufasKe) August 1, 2023

(@RufasKe) August 1, 2023

The widening output spread betwixt Japan and the U.S. reduces incentives for the “yen transportation trade” wherever investors get cheaply successful yen to acquisition higher-yielding U.S. assets. As transportation trades unwind, dollars are repaid and the yen strengthens. Six-month statistic against the U.S. dollar amusement the yen is up much than 11%.

“All these markets are linked unneurotic successful presumption of planetary liquidity flows. People get successful yen to bargain dollars, dollars beryllium astir looking for thing to do, radical accidental we mightiness bargain Treasuries oregon Apple,” the planetary equities money manager astatine Artemis, Simon Edelsten, told Reuters connected July 27.

At the infinitesimal existent enslaved marketplace volatility suggests yields volition stay elevated. The benchmark 10-year Japanese authorities enslaved roseate to 0.6%, up conscionable 0.15 points since Thursday. Markets expect further BOJ involution if yields spike excessively fast. The Federal Reserve has supported measures to supply U.S. dollars to Japan successful a situation aft mounting up swap lines past year. But uncertainty reigns implicit whether dollar spot oregon yen weakness volition dominate.

What bash you deliberation astir the Japanese yen’s caller show and the BOJ’s unwavering stance? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

306

2 years ago

306

English (US) ·

English (US) ·