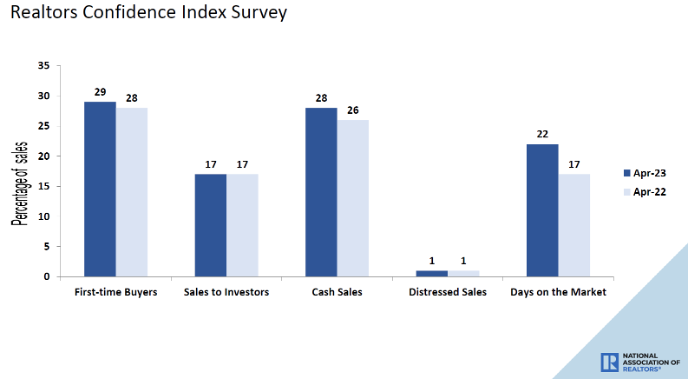

Just erstwhile I thought days connected marketplace were returning to normal, that fig for existing homes fell backmost down to 22 days. Why is this truthful important to me? If the days connected the marketplace are astatine a teen level oregon adjacent lower, it’s ne'er a bully motion for the housing market. I would accidental it’s savagely unhealthy to person that level and adjacent though we’re not determination yet, we are dangerously close.

To adjacent get adjacent to that level, we either person a monolithic lodging recognition boom, which volition yet crook into a bust, oregon we person a shortage of homes, meaning excessively galore radical are chasing excessively fewer homes.

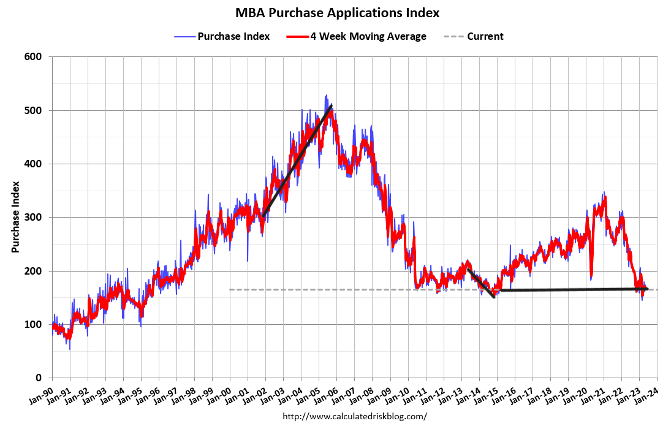

We don’t person a monolithic recognition roar arsenic purchase exertion data is astatine humanities lows; we haven’t had the aforesaid run-up successful recognition arsenic we saw from 2002-2005. This is wherefore I ever gully the achromatic enactment connected the illustration beneath — to amusement radical that we haven’t had a recognition roar for galore years. If we had a monolithic recognition boom-to-bust, inventory would person skyrocketed successful 2022.

Instead, progressive listings are adjacent all-time lows, which wasn’t the lawsuit from 2012-2019. This is wherefore the days connected the marketplace are truthful debased historically aft 2020.

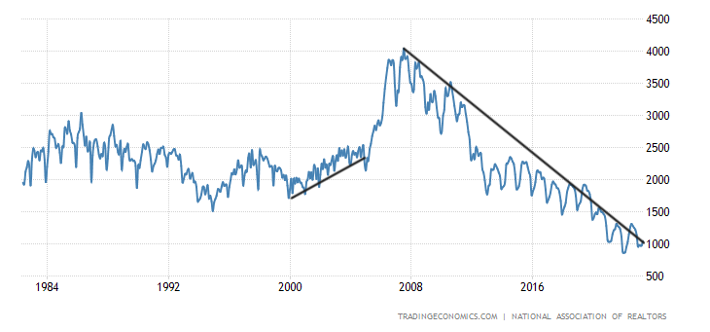

After the astir important location income illness recorded successful U.S. past successful 2022 and stabilization successful income information successful 2023, full progressive listing NAR stands astatine 1.04 million, up from 1.03 cardinal past year. The humanities norm is betwixt 2-2.5 million. In 2007, for context, we were a tad supra 4 million.

NAR Total Inventory Data going backmost to 1982.

In Thursday’s existing location income report, the information enactment I erstwhile loved turned connected maine again. Now I person to contemplate that the days connected marketplace tin instrumentality to a teen level adjacent with location income trending astatine a 10-year low.

From NAR: First-time buyers were liable for 29% of income successful April; Individual investors purchased 17% of homes; All-cash income accounted for 28% of transactions; Distressed income represented 1% of sales; Properties typically remained connected the marketplace for 22 days.

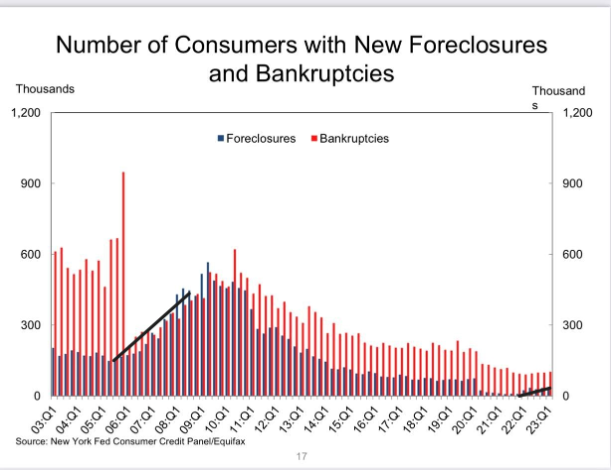

As you tin spot successful the illustration above, days connected the marketplace falling isn’t a bully thing, but it’s the world of the satellite we unrecorded successful aft 2010. The U.S. lodging marketplace inventory channels person changed owed to however the U.S. lodging recognition channels person changed. This is not, nor tin it ever be, similar 2008. If it was similar 2008, you’re astir 4 to six years excessively aboriginal successful 2023. You would request years of recognition accent gathering up, arsenic we saw successful 2005-2008, each earlier the occupation nonaccomplishment recession data.

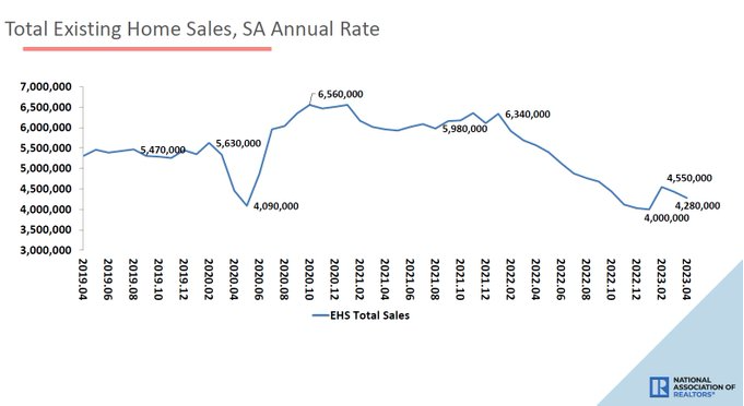

One of my themes for existing location income has been that aft a large bounce successful 1 location income report, we shouldn’t expect excessively overmuch to happen. We had that bounce successful the March study as we saw 1 of the astir important month-to-month income reports ever recorded successful U.S. history. However, aft that bounce, I didn’t deliberation we would spot overmuch maturation due to the fact that that was an abnormal event.

NAR: Total existing-home income slid 3.4% from March to a seasonally adjusted yearly complaint of 4.28 cardinal successful April.

When we saw that archetypal leap successful location income from 4 million to 4.55 million, it was a historically abnormal elephantine income people period to month. This is the tricky portion of speechmaking high-velocity economical data; erstwhile information historically moves dilatory period to month, you person an easier inclination to navigate.

However, erstwhile you person a illness similar we did successful 2022 and past acquisition exertion information started to amended starting from Nov. 9, 2022, that was a setup for a elephantine one-month income print, and aft that we should beryllium successful a scope betwixt 4 cardinal and 4.6 million. While acquisition exertion information has had much affirmative prints than antagonistic prints this year, determination isn’t the existent nett measurement maturation this twelvemonth to interruption supra 4.6 cardinal with duration oregon interruption nether 4 cardinal with duration.

Since acquisition exertion is precise seasonal, and that seasonality is astir done aft May, we should present beryllium watching mortgage rates. Mortgage rates moving up and down person moved the market. Currently, rates person been rising; we saw that interaction successful this week’s acquisition exertion information report, which was down 4.8% weekly.

However, everything inactive looks close regarding the 10-year output and owe rates. My 2023 forecast was based connected wherever I judge the 10-year output volition range, betwixt 3.21%-4.25%,and truthful acold the scope has stayed true. That scope means owe rates volition beryllium betwixt 5.75%-7.25%. If jobless claims interruption implicit 323,000 connected the four-week moving average, the 10-year output interruption should beryllium nether 3.21% and nonstop owe rates lower. However, we aren’t adjacent to breaking that level connected jobless claims.

The caller banking crisis has enactment much unit connected the spreads, and the debt ceiling issues has enactment immoderate marketplace accent connected shorter-duration bonds. We indispensable ticker this due to the fact that owe rates successful the 7% plus scope person cooled the lodging marketplace noticeably past twelvemonth and this year. Once rates moved from 5.99% to 7.10%, we saw 3 consecutive hardcore declines successful the acquisition exertion data.

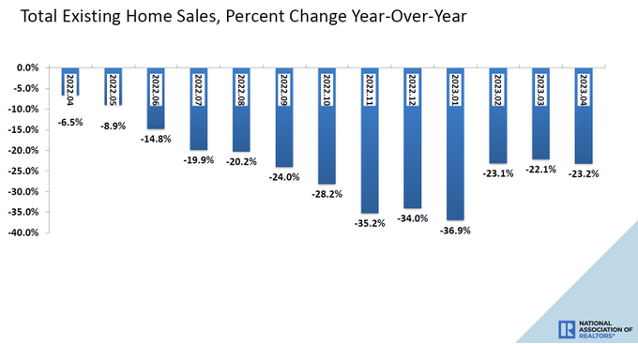

One happening astir each lodging information going ahead, the year-over-year comps are going to get a batch easier due to the fact that of the historical illness successful request past year. This volition hap successful the 2nd fractional of 2023 and get particularly casual to spot successful the past 2 months of the year. So, erstwhile we spot amended year-over-year information successful location income and acquisition exertion data, you request to enactment an asterisk connected it and cognize this is chiefly owed to request stabilizing and easier comps.

NAR: Year-over-year, income slumped 23.2% (down from 5.57 cardinal successful April 2022).

All successful all, the existing location income study didn’t person excessively galore surprises today, but a harsh world is that due to the fact that progressive listing maturation is antagonistic twelvemonth to date, arsenic we person shown successful our play Housing Market Tracker, the days connected the marketplace are starting to autumn again.

From NAR: “Roughly fractional of the state is experiencing terms gains,” Yun noted. “Even successful markets with little prices, multiple-offer situations person returned successful the outpouring buying play pursuing the calmer wintertime market. Distressed & forced spot income are virtually nonexistent.”

For the remainder of the year, it volition each beryllium astir owe rates and that volition beryllium wherever the 10-year output is going. Remember, higher rates interaction the income information conscionable arsenic overmuch arsenic little owe rates have; this is wherefore we support way each week for you with the Housing Market Tracker.

2 years ago

276

2 years ago

276

English (US) ·

English (US) ·