Can we present accidental that the housing market‘s outpouring selling play is yet underway? Since 2020, the seasonal bottommost for housing inventory has arrived respective months aboriginal than normal, making it much analyzable to way lodging inventory data. Still, we person immoderate promising signs that we mightiness person yet deed the inventory bottommost for 2023.

We didn’t spot excessively overmuch volatility successful mortgage rates past week, but acquisition apps declined successful absorption to rates rising 2 weeks ago.

Here’s a speedy rundown of the past week:

- Active listings roseate by 8,546, and caller listing information showed immoderate growth.

- Purchase exertion information was down 10%, keeping the contented of higher rates impacting this play day negatively intact.

- Mortgage rates started the week disconnected astatine 6.61% and ended astatine 6.66%, truthful a calm week connected the complaint front.

Weekly lodging inventory

Looking astatine the Altos Research information from 2 weeks ago, the archetypal happening that popped to my caput erstwhile progressive listings fell and caller listing information fell was that we could person had an Easter Holiday interaction astatine that time. If that is the case, past this week’s summation successful progressive inventory and caller listings needs to beryllium taken with a atom of brackish until we get adjacent week’s data.

My bias is wanting to spot progressive and caller listings information grow, truthful I person to cheque myself erstwhile I spot affirmative lodging inventory information that mightiness request much confirmation.

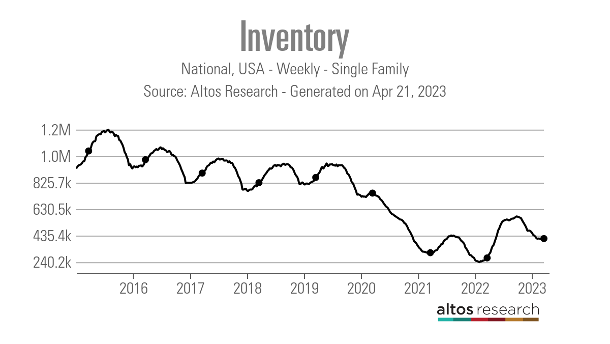

Since 2020, the seasonal inventory bump has happened aboriginal than accustomed — not until March oregon April. I went implicit the reasons for this successful the Housing Wire Daily podcast in February. In summation to the information that lodging inventory since 2020 has been moving astatine all-time lows, acquisition exertion information maturation precocious successful the twelvemonth has pushed retired the seasonal bottommost for the pursuing year.

I anticipation the seasonal bottommost was 2 weeks ago. It’s springtime and we person ever had a accepted outpouring summation successful lodging inventory — it would not beryllium a steadfast motion if we didn’t get progressive listings to turn now.

- Weekly inventory change (April 14-21): Inventory roseate from 405,468 to 414,010

- Same week past twelvemonth (April 15-April 22): Inventory roseate from 267,459 to 271,510

- The bottommost for 2022 was 240,194

- The highest for 2023 truthful far is 472,680

- For context, progressive listings for this week successful 2015: 1,059,330

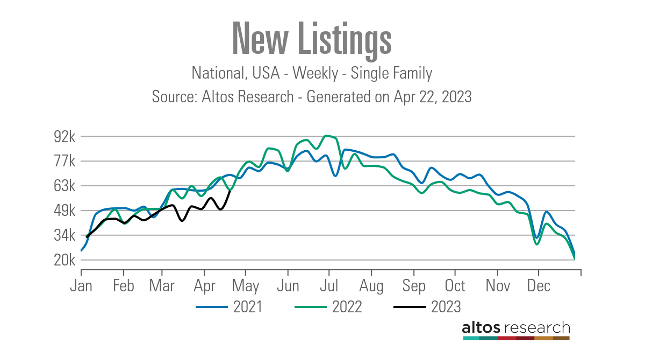

New listing information hasn’t recovered since past year’s large mortgage complaint spike, and we person been trending astatine all-time lows successful 2023. However, for this week, we saw bully week-to-week maturation and the caller listing information for this calendar week isn’t excessively acold disconnected from what we saw successful 2022. Again, I americium a spot mindful present owed to Easter. However, I volition instrumentality what I tin now.

New listings:

- 2021: 69,025

- 2022: 60,351

- 2023: 59,926

For immoderate humanities perspective, backmost erstwhile lodging inventory levels were normal, present are the play caller listing numbers for 2015-2017:

- 2015: 88,972

- 2016: 95,131

- 2017: 77,570

As you tin spot successful the illustration below, caller listing information is highly seasonal, truthful we don’t person overmuch clip near earlier the seasonal diminution successful the information line.

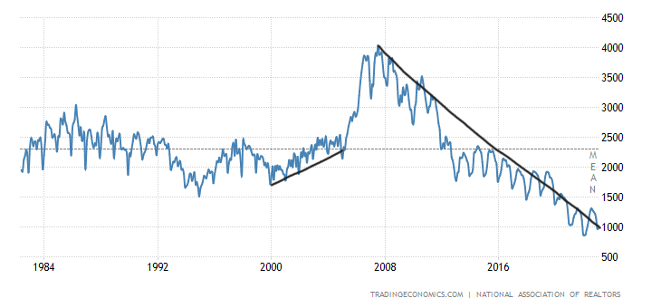

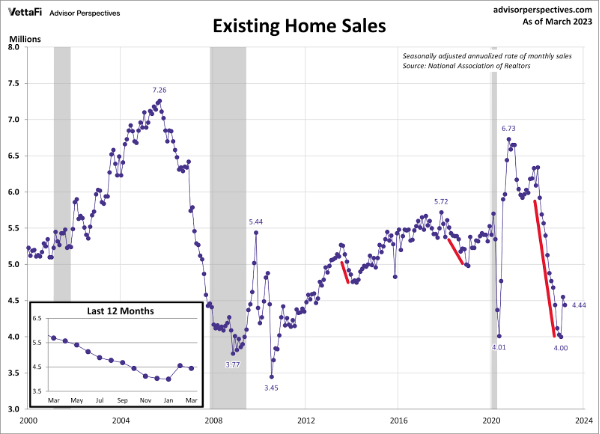

The NAR data going backmost decades shows however hard it’s been to get backmost to thing mean connected the progressive listing broadside post-2020. In 2007, erstwhile income were down big, full progressive listings peaked astatine over 4 million. Back past we had precocious inventory levels portion the unemployment complaint was inactive excellent. It shows what a monolithic recognition bubble we were successful backmost then, but nary of that enactment has been happening for years.

Even though contiguous income are trending astatine 2007 levels, we are lone astatine 980,000 full progressive listings per the past existing location income report.

People often inquire maine wherefore determination is specified a quality betwixt the NAR information versus the Altos Research inventory data. This link explains the quality and is worthy a read.

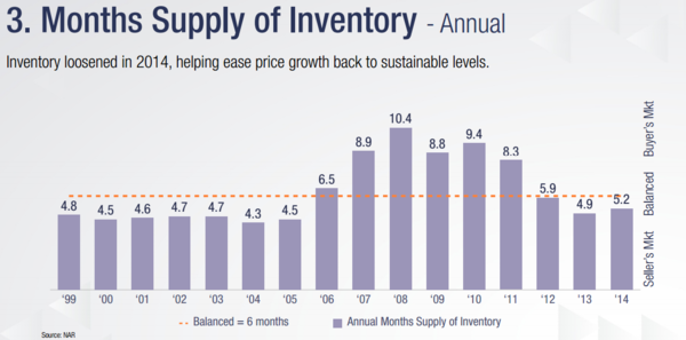

On the monthly proviso for existing homes, I cognize banal traders and YouTube radical are notorious for comparing everything to lodging successful 2008. Below is the monthly proviso of existing homes from 1999-2014, wherever you tin intelligibly spot the maturation successful monthly proviso from 2006-2011. The reddish enactment is wherever NAR believes a balanced marketplace is, astatine six months of supply. I judge that fig is 4 months. Either way, contiguous the monthly proviso of 2.6 months shows however acold we are from 2008 lodging economics.

Contrast the illustration supra — which is NAR monthly proviso information from 1999-2014 — with the illustration below, which is NAR monthly proviso information from 2013-2023. As you tin successful the illustration below, the monthly proviso information shows we person nary forced selling enactment successful the lodging marketplace today, dissimilar the 2006-2011 period.

The 10-year output and owe rates

Last week, owe rates didn’t determination much, adjacent though the jobless claims information is getting softer. Despite the main economist astatine The Conference Board stating connected CNBC past week that they judge the recession has already started, we didn’t spot excessively overmuch enactment connected the 10-year output and rates. I presented my six recession reddish flags exemplary to The Conference Board past year. A batch of my absorption connected wherever enslaved yields and owe rates tin spell is based connected wherever the labour marketplace is heading, so, The Conference Board stating we are starting a recession present is simply a large deal.

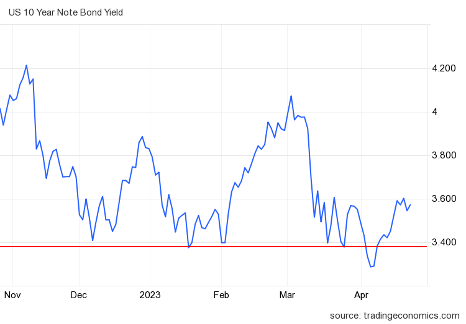

In my 2023 forecast, I said that if the system stays firm, the 10-year output scope should beryllium betwixt 3.21% and 4.25%, equating to 5.75% to 7.25% owe rates. If the system gets weaker and we spot a noticeable emergence successful jobless claims, the 10-year output should spell arsenic debased as 2.73%, translating to 5.25% owe rates.

As you tin spot successful the illustration below, we person stayed successful the steadfast economical 10-year output scope 100% of the time. We tin besides spot however hard it’s been for the 10-year output to interruption beneath the 3.37%-3.42% country with immoderate conviction.

The labour market, portion getting somewhat softer recently, hasn’t breached this twelvemonth yet, truthful adjacent with each the play we’ve seen successful 2023, the enslaved marketplace has held wrong its due channel, meaning owe rates should enactment successful the scope betwixt 5.75%-7.25%.

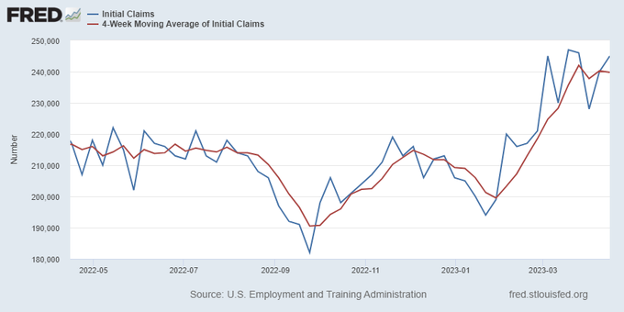

I americium watching jobless claims due to the fact that the Fed volition pivot its connection connected the system erstwhile jobless claims get supra 323,000 on the four-week moving average. However, we are inactive acold from those levels, adjacent though it has risen recently. Last week archetypal jobless claims accrued by 11,000, and the four-week moving mean roseate to 239,750.

Purchase exertion data

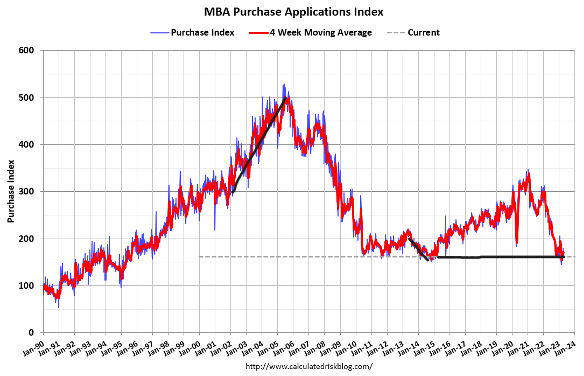

Purchase exertion information has been a agleam spot arsenic acold arsenic lodging marketplace data. In 2022, location income collapsed successful a waterfall fashion. However, starting connected Nov. 9, 2022, acquisition exertion information began to amended and that betterment has created stabilization successful the income information successful 2023.

Since Nov. 9, excluding immoderate vacation weeks, we person had 15 affirmative and six antagonistic acquisition exertion prints. This year, we person had 8 affirmative prints versus six antagonistic prints. This scale is precise rate-sensitive. For the astir part, erstwhile owe rates person risen this year, we person seen this scale autumn week to week, and that is what we saw past week arsenic the scale was down 10% week to week and down 36% twelvemonth implicit year.

As the illustration beneath shows, we person a shallow barroom successful this information enactment since the clang successful 2022.

As I person often stressed erstwhile I speech astir this information line, don’t deliberation of this arsenic the V-shaped recovery we saw during COVID-19, but conscionable stabilization and maturation from a debased bar. Every twelvemonth I usually measurement this scale from the 2nd week of January to the archetypal week of May — traditionally, aft May, volumes ever fall.

Now, if the system gets weaker aboriginal successful the twelvemonth and owe rates autumn astatine that time, we each request to absorption much connected acquisition exertion data. The past fewer years person seen affirmative acquisition exertion numbers successful autumn and wintertime and we tin marque a lawsuit for that happening again if owe rates interruption beneath 6% this year.

The week ahead: Four lodging reports to chew connected

On Tuesday, we person the caller location income report, the lagging S&P CoreLogic Case-Shiller location terms report, and the FHFA location terms index. Of course, we each cognize the month-to-month pricing information has firmed up arsenic the lodging economical communicative of the 2nd fractional of 2022 has changed this year. Keep things simple: request has stabilized and progressive listings are inactive historically low.

For the builders, their stocks person been connected fire, which has driven immoderate abbreviated banal traders mad! However, I privation to spot what their progressive monthly proviso information looks similar now; the cardinal for maine is getting monthly proviso beneath 6.5 months. While lodging completions are inactive rising, which is good, we haven’t had maturation successful lodging permits, which is cardinal successful getting lodging retired of the recession.

We besides person the pending location income study connected Thursday, which has already had a large bounce from the lows. It gets harder to support the bounce going if acquisition apps don’t amusement much growth. We besides person to retrieve astir 30% of homes are inactive bought with cash, truthful lodging request doesn’t request to beryllium 100% driven by owe buyers.

As always, I volition support a adjacent oculus connected jobless claims and each time tin bring retired immoderate brainsick quality that tin determination the enslaved market. In time, arsenic we get person and person to the indebtedness ceiling, we volition code the marketplace concerns and what it could mean for the economy.

2 years ago

459

2 years ago

459

English (US) ·

English (US) ·