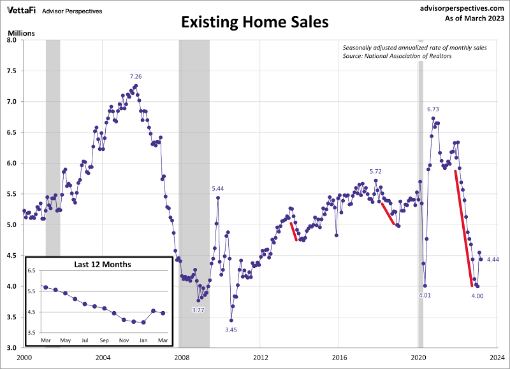

We lone person 2.6 months’ worthy of housing inventory successful the U.S. aft coming disconnected the azygous biggest home-sales clang twelvemonth successful history. That is wherever we are contiguous successful America. As expected, existing location sales fell from February to March since the erstwhile month’s study was intense.

We person a workable scope for 2023 income successful the existing location income marketplace betwixt 4 cardinal and 4.6 million. If we are trending beneath 4 cardinal — a anticipation with caller listing information trending astatine all-time lows — past we person overmuch weaker request than radical think. Now if we get a fewer income prints supra 4.6 million, past request is amended than the archetypal bounce we had earlier successful the year.

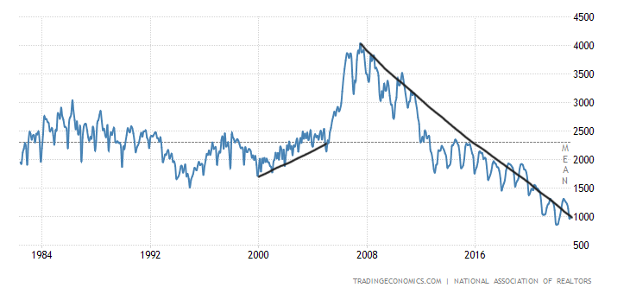

To get backmost to the pre-COVID-19 income range, we request to spot existing location income inclination between 4.72 – 5.31 million for astatine slightest 12 months. That isn’t happening. We are moving from a debased bar, and arsenic I person stressed implicit the years, it’s sporadic post-1996 to person a monthly income inclination beneath 4 million. In the illustration below, with the reddish lines drawn, you tin spot however antithetic the income clang successful 2022 was compared to the past 2 times rates roseate and income fell.

From NAR: Total existing-home sales – completed transactions that see single-family homes, townhomes, condominiums, and co-ops – fell 2.4% from February to a seasonally adjusted yearly complaint of 4.44 cardinal successful March. Year-over-year, income waned 22.0% (down from 5.69 cardinal successful March 2022).

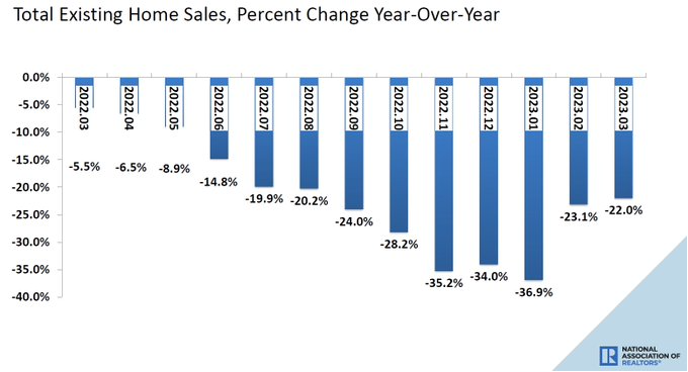

Last twelvemonth we had a important income diminution for the existing location income market, which got worse arsenic the twelvemonth progressed. When looking astatine year-over-year information for the remainder of the year, we person to retrieve that the year-over-year income declines volition amended conscionable due to the fact that the comps volition get easier. That volition prime up velocity toward the 2nd fractional of 2023 and we could spot immoderate affirmative year-over-year information toward the extremity of the year.

NAR: Year-over-year, income waned 22.0% (down from 5.69 cardinal successful March 2022).

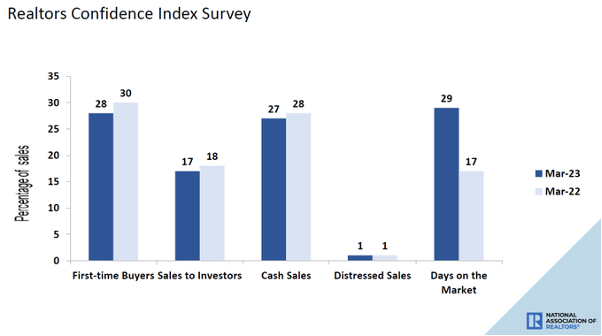

One facet I didn’t similar to spot successful this study is that the days connected marketplace fell and are backmost to nether 30 days. This is the world of our world: full progressive listings are inactive adjacent all-time lows and request truthful acold has been unchangeable since Nov. 9, 2022.

As we tin spot successful the information below, the days connected the marketplace fell backmost down to 29 days. I americium hoping that it doesn’t spell little than this. For immoderate humanities context, backmost successful 2011, this information enactment was 101 days.

NAR: First-time buyers were liable for 28% of income successful March; Individual investors purchased 17% of homes; All-cash income accounted for 27% of transactions; Distressed income represented 1% of sales; Properties typically remained connected the marketplace for 29 days.

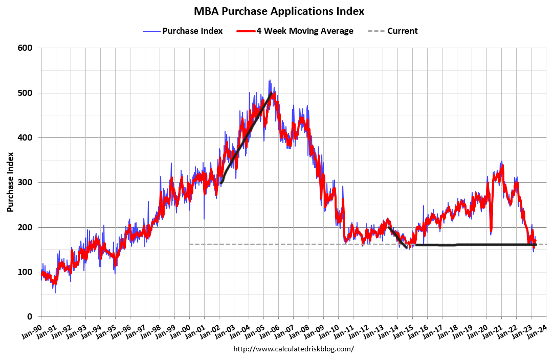

When I speech astir stabilization successful request since Nov. 9, I americium looking astatine acquisition exertion information since that date, and — excluding immoderate vacation weeks that I don’t enactment immoderate value connected —we person had 15 affirmative prints versus six antagonistic prints successful that time. So, portion the illustration beneath doesn’t look similar what we saw successful the COVID-19 recovery, it has stabilized.

I enactment the astir value connected this information enactment from the 2nd week of January to the archetypal week of May. After May, traditionally speaking, full volumes usually fall. Now, post-2020, we person had 3 consecutive years of late-in-the-year runs successful this information enactment to messiness everything up. However, sticking to my past work, I person seen eight positive prints versus six negative prints this year. So, I wouldn’t telephone this a booming request propulsion higher, conscionable a stabilization play utilizing a debased bar.

NAR: Total lodging inventory registered astatine the extremity of March was 980,000 units, up 1.0% from February and 5.4% from 1 twelvemonth agone (930,000). Unsold inventory sits astatine a 2.6-month proviso astatine the existent income pace, unchanged from February but up from 2.0 months successful March 2022.

Total lodging inventory, portion up twelvemonth implicit year, is inactive adjacent all-time lows, and monthly proviso is besides up twelvemonth implicit year. However, arsenic we each know, lodging inventory reached an all-time debased successful 2022, truthful you request discourse erstwhile talking astir the year-over-year data. As we tin spot below, from 2000, full progressive lodging inventory roseate from 2 million to 2.5 cardinal before we saw the monolithic accent spike successful proviso from 2005 to 2007.

The NAR information looks a spot backward, truthful if you privation much caller play data, I constitute the Housing Market Tracker every week connected Sunday nighttime to springiness you that information.

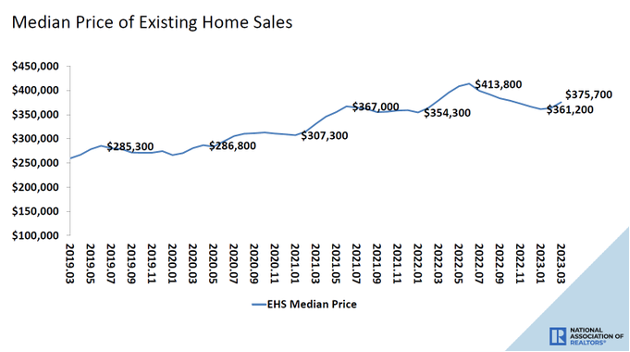

One happening higher mortgage rates person done for definite is that home-price maturation is cooling down noticeably since the large spike successful rates. That maturation isn’t cooling arsenic overmuch arsenic I would like, tied to my years 2020-2024 price-growth exemplary for a unchangeable lodging market. However, I volition instrumentality what I tin get astatine this point.

NAR: The median existing-home terms for each lodging types successful March was $375,700, a diminution of 0.9% from March 2022 ($379,300). Price climbed somewhat successful 3 regions but dropped successful the West.

The astir shocking information we person seen successful the lodging marketplace since the large clang successful location income is however debased inventory inactive is successful the U.S. — but for those speechmaking HousingWire oregon listening to the HousingWire Daily podcast.

Remember, inventory channels are antithetic present due to the fact that recognition channels successful the U.S. are antithetic post-2010. Also, request has stabilized since Nov. 9, truthful erstwhile we speech astir lodging successful the U.S., let’s usage the information that makes sense.

Stable demand, debased lodging inventory, and nary forced sellers are wherefore we created the play Tracker, to absorption connected close information and what matters astir to lodging economics and the U.S. economy.

2 years ago

426

2 years ago

426

English (US) ·

English (US) ·