One of the astir palmy hedge money strategies of caller years — insurance-linked securities — is latching connected to an aged idea whose popularity is abruptly soaring.

Parametric insurance, wherever policyholders get speedy payouts if weather-related metrics are met, utilized to beryllium the sphere of tiny businesses and farmers successful processing countries. Now, it’s a rapidly growing marketplace luring ample corporations crossed the affluent world.

Sebastien Piguet, co-founder and main security serviceman astatine Descartes Underwriting, says parametric models are filling a spread near by different types of security policies. That’s arsenic clime alteration and much predominant utmost upwind events challenge modular coverage models.

“It’s overmuch much challenging to find capableness for this benignant of sum with accepted insurance,” helium said.

Companies utilizing parametrics present see French pharmaceutical steadfast Sanofi SA, telecommunications institution Liberty Latin America, and renewable vigor capitalist Greenbacker Capital Management. The marketplace for specified products is estimated to astir double to $34 cardinal successful the decennary done 2033.

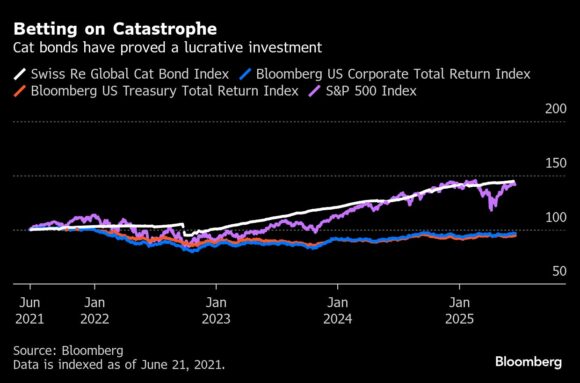

It’s a displacement that’s caught the attraction of ILS concern managers. Insurance-linked securities, which a Preqin ranking listed arsenic the best-performing hedge money strategy of 2023, person agelong focused connected catastrophe bonds. Typically issued by insurers and reinsurers, investors successful the bonds marque wealth if predefined triggers similar upwind velocity oregon insured losses aren’t met, and suffer wealth if they are.

In caller years, that exemplary has generated market-beating returns.

Investment funds based connected parametric security person the imaginable to bushed feline enslaved returns, according to Rhodri Morris, a portfolio manager astatine Twelve Securis. The Zurich-based $8.6 billion alternate concern manager, which specializes successful catastrophe bonds, launched the Lumyna-Twelve Capital Parametric ILS Fund unneurotic with Lumyna Investments successful February.

“We purpose to instrumentality a mates of percent points supra the feline enslaved market,” Morris said successful an interview.

The fund, which is the archetypal of its kind, has truthful acold attracted astir €85 cardinal ($99 million) of capital. Morris says the anticipation is that it volition gully arsenic overmuch arsenic €200 cardinal adjacent year.

A cardinal attraction for investors is they tin debar alleged trapped capital, according to Morris. Investors successful feline bonds sometimes hold for months — oregon adjacent years — earlier nonaccomplishment rates are assessed and payouts settled. Investors successful a parametric money volition mostly cognize wrong days whether an underlying security declaration has paid retired oregon not.

The Lumyna-Twelve parametric money has drawn “genuine interest” from investors, Morris said. But they’ve besides had questions, and there’s a fig of important factors to consider, helium said.

“Investors request to recognize that you’re giving up liquidity successful immoderate portion of the portfolio,” Morris said. “But the benefits you’re getting are higher returns and the deficiency of trapping.”

The money has received effect superior from what it describes arsenic a “top-tier European organization investor.” Morris declined to place the steadfast by name.

Luca Albertini, main enforcement of Leadenhall Capital Partners, a London-based steadfast which oversees $4.5 cardinal successful ILS assets including a fewer backstage parametric deals, says that portion investors payment from the transparency and speedy payouts of parametric products, they request to prime investments with care.

“The attractiveness of parametric comes and goes,” and “you request to beryllium watchful that the risk-reward remains charismatic compared to alternatives successful the aforesaid space,” specified arsenic feline bonds, helium said.

The Lumyna-Twelve money volition beryllium structured truthful that portion of the superior volition enactment deals it strikes itself. For these, it volition trust connected Descartes to operation the transactions, and connected Assicurazioni Generali SpA — the genitor of Lumyna — to supply the security superior to backmost the product.

Returns are besides based connected parametric deals done by Descartes and its spouse Generali for their ain clients. These volition beryllium bundled, with the Lumyna-Twelve money escaped to put successful a chunk of the extremity product.

Homes surrounded by floodwater aft Hurricane Beryl made landfall successful Sargent, Texas, connected July 8, 2024. Photo credit: Eddie Seal/Bloomberg

Homes surrounded by floodwater aft Hurricane Beryl made landfall successful Sargent, Texas, connected July 8, 2024. Photo credit: Eddie Seal/BloombergClimate-related economical losses successful the US person reached $6.6 trillion implicit the past 12 years, truthful figuring retired however to woody with utmost upwind events is nary longer conscionable an biology concern, but a “significant fiscal issue,” Bloomberg Intelligence said successful a caller report.

Against that backdrop, firm request for parametrics keeps growing. Cyril Lelarge, planetary caput of security astatine Sanofi, says the institution has been relying progressively connected parametric sum arsenic it looks for ways to defender its proviso chain. “It’s important for america to support our assets for the future,” helium said.

Liberty Latin America says it bought “several 100 cardinal dollars worth” of hurricane parametric security successful 2024. When Hurricane Beryl hit past July, Liberty says it got a speedy payout of $44 million, which helped the institution rebuild damaged infrastructure.

Descartes has besides launched parametric screen for star farms against tornado damage. And Aon Plc, an security broker, has unneurotic with Swiss Re and Floodbase rolled retired a argumentation for hurricane-related tempest surge on the US coast, portion Axa SA has introduced a merchandise that protects outdoor workers successful Hong Kong from vigor waves.

Parametric deals are besides progressively fashionable among renewables firms, with star plants successful Texas acquiring policies against hailstorms, and upwind farms utilizing them arsenic a fiscal buffer erstwhile the upwind fails to stroke and gross drops.

For Greenbacker Capital Management, the parametric sum it received from Munich Re, successful conjunction with a “wind proxy hedge” that it structured with kWh Analytics, helped it pull lenders, according to Dan de Boer, interim main enforcement astatine Greenbacker.

“It allowed america to rise 20% much indebtedness capital” for a US upwind project, helium said.

Photograph: Members of the Mexican Army behaviour sweeps aft Hurricane Beryl made landfall successful Tulum, Mexico, connected July 5, 2024. Photo credit: Victoria Razo/Bloomberg

Copyright 2025 Bloomberg.

Topics Catastrophe Trends

7 months ago

684

7 months ago

684

English (US) ·

English (US) ·