Grayscale Investments volition database spot ETFs for Dogecoin and XRP connected the NYSE Arca connected November 24, 2025, offering a caller mode for mundane investors to bargain those coins done regular brokerages.

According to speech notices and regulatory filings, the funds volition commercialized nether the tickers GDOG for Dogecoin and GXRP for XRP. The listings person Grayscale’s existing private-placement trusts into publically traded products.

Grayscale Moves To List Dogecoin And XRP

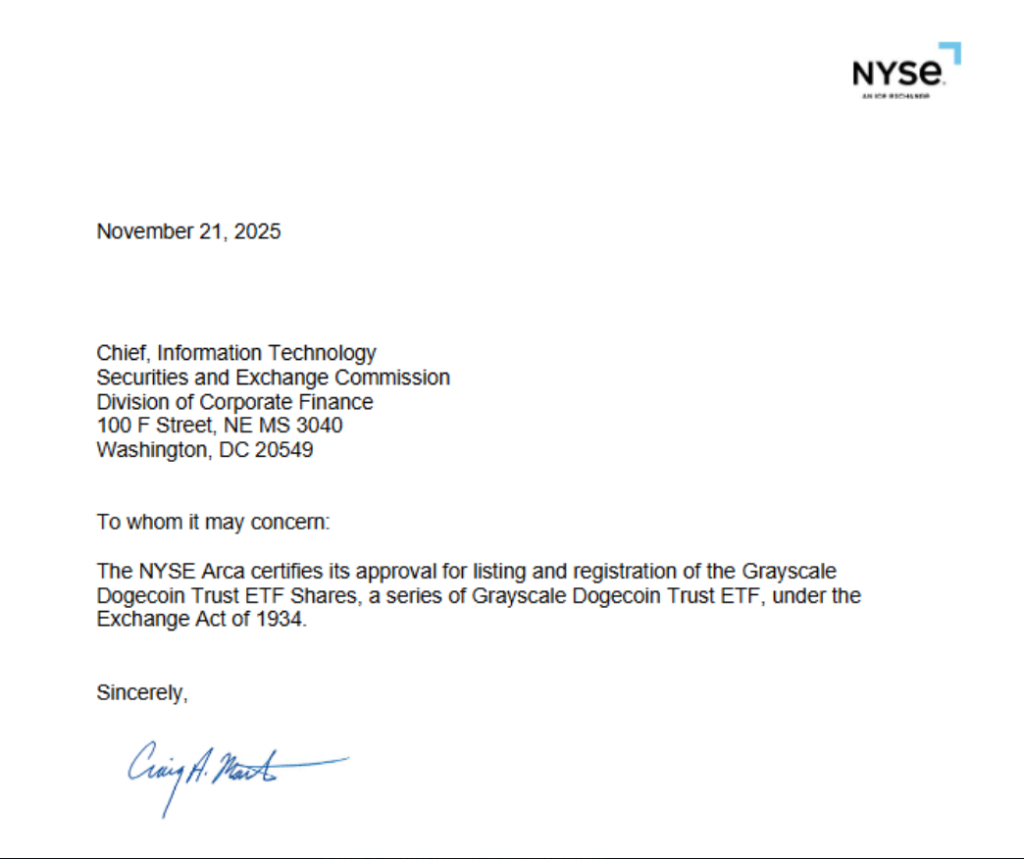

Reports person disclosed that some ETFs received support to beryllium listed, and the paperwork was filed with the US Securities and Exchange Commission.

The determination brings spot vulnerability to 2 smaller, but wide followed, cryptocurrencies into a mainstream vehicle. For galore investors, that means entree without straight managing wallets oregon backstage keys.

Grayscale Dogecoin ETF $GDOG approved for listing connected NYSE, scheduled to statesman trading Monday. Their XRP spot is besides launching connected Monday. $GLNK coming soon arsenic well, week aft I deliberation pic.twitter.com/c6nKUeDrtI

— Eric Balchunas (@EricBalchunas) November 21, 2025

Market Activity Up Ahead Of Launch

Trading enactment successful related derivatives climbed successful the pb up to the announcement. Dogecoin derivatives measurement accrued by much than 30% to astir $7.22 billion, based connected speech data.

XRP derivatives surged arsenic well, jumping astir 51% to astir $12.74 billion. Based connected reports, these spikes bespeak traders positioning for imaginable terms swings astir the ETF debut.

Spot ETFs bash not committedness higher prices, but they bash alteration who tin bargain the assets. Brokers, status plans, and funds that debar nonstop crypto custody whitethorn present measurement in.

That could impact liquidity successful some the tokens and their markets. At the aforesaid time, the wide crypto marketplace has seen pressure; reports accidental the launches travel during a astir six-week downturn.

Product fees, custody details, and however the trusts person into ETF shares volition signifier capitalist appetite. Past launches of crypto ETFs showed brisk aboriginal flows for immoderate products, portion others saw muted interest. What matters for prices is not lone listings, but inflows and outflows erstwhile trading begins.

Investors and analysts are apt to ticker the archetypal days of trading for clues. High measurement and choky spreads would suggest beardown demand. Low turnover oregon wide spreads could awesome tepid interest.

Based connected reports, marketplace participants volition besides show whether the ETFs gully the aforesaid benignant of speculative trading that has driven derivatives measurement successful caller days.

The listing of some GDOG and GXRP connected the aforesaid day marks a notable measurement for mainstream crypto products. According to speech filings, the funds are structured arsenic spot ETFs that clasp the underlying tokens via custodians. While that does not region terms risk, it does marque buying these assets simpler for a wide radical of investors.

Featured representation from Gemini, illustration from TradingView

English (US) ·

English (US) ·