Pantera Capital laminitis Dan Morehead believes a geopolitical displacement successful reserve absorption volition propulsion adversaries of the United States into Bitcoin astatine monolithic scale, calling it “inevitable” that China and Russia yet clasp “trillions of dollars” worthy of the asset.

Speaking connected Blockworks’ Empire podcast released this week, the billionaire framed the prediction arsenic portion of a longer-term rotation successful planetary reserve assets and a effect to authorisation hazard embedded successful dollar-denominated holdings. “I deliberation it’ll instrumentality a decennary oregon two,” Morehead said, adding that the archetypal movers volition apt see US-aligned Gulf states earlier “the large one” arrives with countries “antagonistic to the United States, similar China oregon Russia.”

Why Russia And China Will Adopt Bitcoin

Morehead anchored his statement successful the humanities cadence of reserve transitions and the vulnerability of holding claims connected a rival’s fiscal system. “You gotta remember, the reserve currency’s changed each 80 oregon 100 years… nary one’s ever truly lasted for much than, let’s telephone it 100, 110 years,” helium said.

While calling it “inconceivable that the dollar volition beryllium supplanted” overnight, helium warned that countries with ample US Treasury positions look concentrated governmental risk. Citing China’s portfolio, helium argued: “It’s truly beauteous brainsick to person your full country’s beingness savings successful an plus that your imaginable adversary could virtually conscionable cancel.” In his view, that calculus makes it “inevitable” that specified countries “will person started to prevention successful Bitcoin and different cryptocurrencies” wrong the adjacent decade.

The provocation lands amid measurable changes successful however large economies clasp US debt. Official Treasury information for July 2025 amusement China’s reported Treasury holdings astatine $730.7 billion, the lowest since 2008 and down markedly implicit the past decade, a diminution often work arsenic gradual diversification of reserves alternatively than abrupt abandonment.

JUST IN: BILLIONAIRE DAN MOREHEAD JUST SAID IT’S “INEVITABLE” CHINA AND RUSSIA WILL HOLD TRILLIONS OF DOLLARS IN #BITCOIN

NATION STATE GAME THEORY. IT’S HERE  pic.twitter.com/tOQO9tHYNi

pic.twitter.com/tOQO9tHYNi

— The Bitcoin Historian (@pete_rizzo_) September 23, 2025

Japan remains the largest holder astatine astir $1.15 trillion, with the United Kingdom adjacent $900 billion. The broader excavation of foreign-held Treasuries nevertheless deed a grounds successful July. These figures exemplify that portion the dollar strategy remains heavy and liquid, China’s stock is slipping astatine the margin—the nonstop dynamic Morehead argues could accelerate alternate reserve strategies implicit time.

Morehead’s timeline besides intersects with a flurry of argumentation proposals that, if enacted, would normalize sovereign Bitcoin exposure. In March, US President Donald Trump signed an enforcement order establishing a Strategic Bitcoin Reserve and a nationalist integer plus stockpile. Wyoming legislators separately precocious a measure to licence constricted Bitcoin investments—capped astatine 3%—within definite authorities funds, an incremental measurement toward organization reserve absorption successful integer assets astatine the authorities level.

Outside the US, Gulf governments are already experimenting astatine the edges of sovereign crypto exposure—another plank successful Morehead’s thesis. The United Arab Emirates’ has launched state-backed mining initiatives and disclosures suggesting respective 1000 BTC accumulated connected the equilibrium expanse via those operations.

Skeptics volition enactment that moving “trillions” of dollars into Bitcoin would necessitate not lone argumentation shifts but besides marketplace operation susceptible of absorbing sustained sovereign request without disorderly volatility. Liquidity extent has improved with US spot ETF adoption and increasing derivatives markets, yet Bitcoin’s escaped float, custody frameworks, and cross-border outgo rails inactive look periodic stress.

Morehead, however, situates the thesis successful a agelong arc alternatively than a short-term trade. “I don’t deliberation it’s gonna hap overnight,” helium said, emphasizing a skyline of “a decennary oregon two” and a phased way successful which US-aligned adopters pave the mode for politically non-aligned states that prize censorship absorption and authorisation insulation.

For China and Russia specifically, the impetus would beryllium arsenic overmuch strategical arsenic financial. China’s willingness to spot distant astatine Treasuries aligns with its broader propulsion to diversify reserves into golden and different assets, portion Russia’s post-2014 and 2022 sanctions acquisition has already driven a melodramatic reconfiguration of its reserve composition.

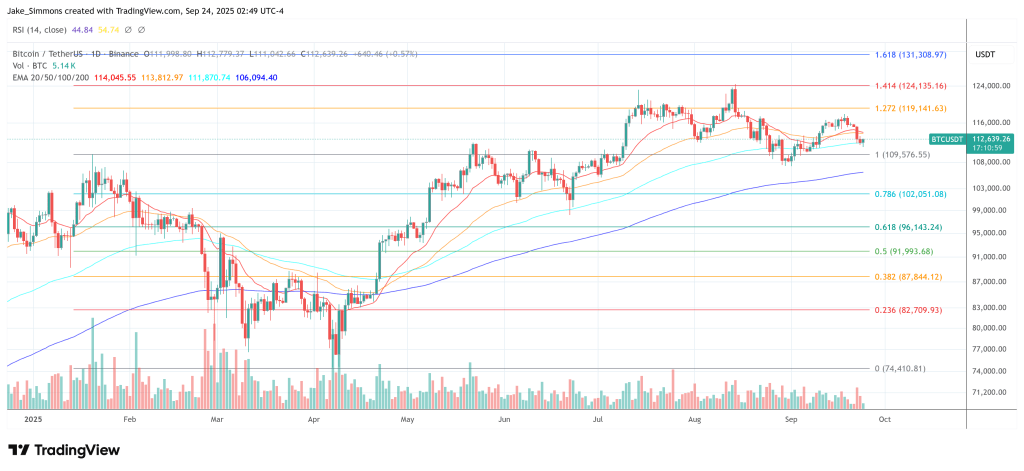

At property time, Bitcoin traded astatine $112,639.

English (US) ·

English (US) ·