Bitcoin’s disposable coins for trading person dropped sharply. That alteration could propulsion prices higher if request holds up.

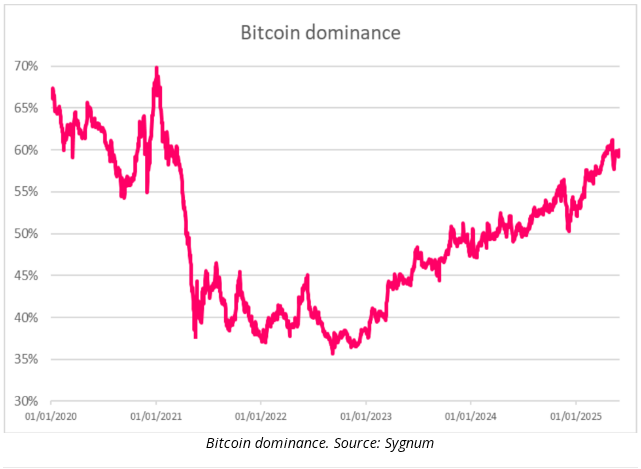

According to Sygnum Bank’s June 2025 Monthly Investment Outlook, the liquid proviso of Bitcoin fell by astir 30% implicit the past 18 months. In that time, astir 1 cardinal BTC near exchanges. That means less coins are acceptable to determination astatine a moment’s notice.

Liquid Supply Tightens

Based connected reports from Sygnum Bank, speech balances dropped by astir 1 cardinal BTC since precocious 2023. That magnitude equals astir 5% of Bitcoin’s full supply.

When coins permission exchanges, they often spell into acold retention oregon semipermanent funds. Some of these funds see caller exchange-traded funds and firm buyers issuing equity oregon indebtedness to bargain Bitcoin.

If coins are locked away, traders person to vie for a smaller excavation of disposable coins. That spread betwixt proviso and request tin origin bigger terms swings connected the upside.

Institutions And State Moves

Three US states person present passed laws to clasp Bitcoin arsenic portion of their reserves. New Hampshire already signed its measure into law. Texas is expected to travel soon. A 3rd authorities is besides moving forward, though details are inactive pending.

In addition, governments overseas are paying attention. Pakistan’s authorities has said it volition look into Bitcoin reserves. In the UK, the Reform Party—currently starring successful predetermination polls—plans to survey thing similar.

When a authorities oregon state really buys Bitcoin for its coffers, it tin spark much buying. That enactment has a treble effect: it creates contiguous request and it signals that nationalist institutions spot Bitcoin arsenic a store of value.

Rising uncertainty implicit the US dollar and US indebtedness worries person driven immoderate investors toward Bitcoin. In May, arsenic US Treasury prices slid connected concerns astir rising indebtedness levels, integer golden and carnal golden saw higher interest.

Bitcoin is being viewed much similar a hedge against dollar weakness. On days erstwhile Treasuries wobble, immoderate currency moves into crypto markets. Larger swings connected the upside than connected the downside besides hint that institutions whitethorn beryllium soaking up dips much quickly.

Sygnum’s information shows that since June 2022, Bitcoin’s upward moves person been larger than its downward moves. That whitethorn beryllium a motion that large players person go much assured successful holding done tiny sell-offs.

Ethereum’s ComebackEthereum is besides stirring aft a play of sluggish performance. The caller Pectra upgrade connected Ethereum has spurred much fees and drafting caller interest. Several large banks and fiscal firms are present exploring tokenization platforms built connected Ethereum and its layer-2 networks.

When much institutions contented tokenized assets, the full crypto abstraction could benefit. Renewed enactment connected Ethereum often spills backmost into Bitcoin. That could adhd to wide request for apical coins.

Featured representation from Imagen, illustration from TradingView

English (US) ·

English (US) ·