While galore bitcoin investors look for the plus to behave arsenic a harmless haven, bitcoin typically has yet acted arsenic the riskiest of each hazard allocations.

The beneath is an excerpt from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Short-Term Price Versus Long-Term Thesis

How bitcoin, the asset, volition behave successful the aboriginal versus however it presently trades successful the marketplace person proven to beryllium drastically antithetic from our semipermanent thesis. In this piece, we’re taking a deeper look into those risk-on correlations, and comparing the returns and correlations crossed bitcoin and different plus classes.

Consistently, tracking and analyzing these correlations tin springiness america a amended knowing if and erstwhile bitcoin has a existent decoupling infinitesimal from its existent trend. We don’t judge we are successful that play today, but expect that decoupling to beryllium much apt implicit the adjacent 5 years.

Macro Drives Correlations

For starters, we’re looking astatine the correlations of one-day returns for bitcoin and galore different assets. Ultimately we privation to cognize however bitcoin moves comparative to different large plus classes. There’s a batch of narratives connected what bitcoin is and what it could be, but that’s antithetic from however the marketplace trades it.

Correlations scope from antagonistic 1 to 1 and bespeak however beardown of a narration determination is betwixt 2 variables, oregon plus returns successful our case. Typically, a beardown correlation is supra 0.75 and a mean correlation is supra 0.5. Higher correlations amusement that assets are moving successful the aforesaid absorption with the other being existent for antagonistic oregon inverse correlations. Correlations of 0 bespeak a neutral presumption oregon nary existent relationship. Looking astatine longer windows of clip gives a amended denotation connected the spot of a narration due to the fact that this removes short-term, volatile changes.

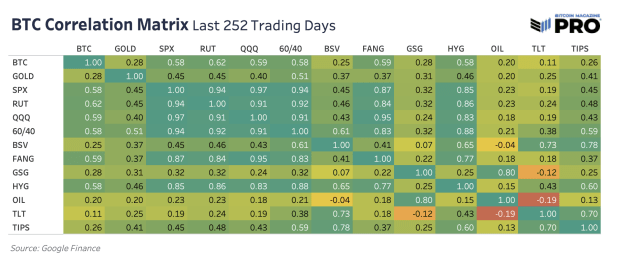

What’s been the astir watched correlation with bitcoin implicit the past 2 years is its correlation with “risk-on” assets. Comparing bitcoin to accepted plus classes and indexes implicit the past twelvemonth oregon 252 trading days, bitcoin is astir correlated with galore benchmarks of risk: S&P 500 Index, Russel 2000 (small headdress stocks), QQQ ETF, HYG High Yield Corporate Bond ETF and the FANG Index (high-growth tech). In fact, galore of these indexes person a beardown correlation to each different and goes to amusement conscionable however powerfully correlated each assets are successful this existent macroeconomic regime.

The array beneath comparison bitcoin to immoderate cardinal asset-class benchmarks crossed precocious beta, equities, lipid and bonds.

Note, you tin find immoderate of these indexes/assets connected Google Finance with the tickers above. For 60/40, we’re utilizing BIGPX Blackrock 60/40 Target Allocation Fund, GSG is the S&P GSCI Commodity ETF, and BSV is the Vanguard Short-Term Bond Index Fund ETF.

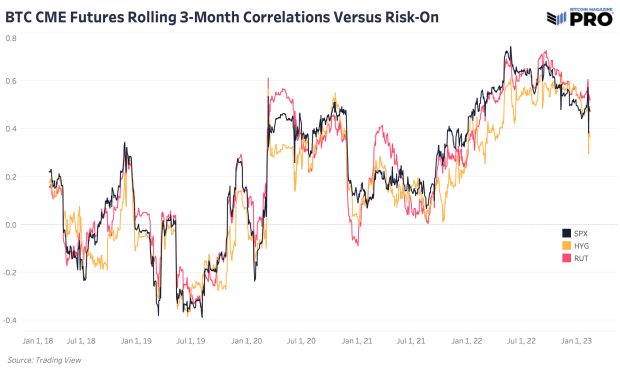

Note, you tin find immoderate of these indexes/assets connected Google Finance with the tickers above. For 60/40, we’re utilizing BIGPX Blackrock 60/40 Target Allocation Fund, GSG is the S&P GSCI Commodity ETF, and BSV is the Vanguard Short-Term Bond Index Fund ETF. Another important enactment is that spot bitcoin trades successful a 24/7 marketplace portion these different assets and indexes bash not. Correlations are apt understated present arsenic bitcoin has proven to pb broader risk-on oregon liquidity marketplace moves successful the past due to the fact that bitcoin tin beryllium traded astatine immoderate time. As bitcoin’s CME futures marketplace has grown, utilizing this futures information produces a little volatile presumption of correlation changes implicit clip arsenic it trades wrong the aforesaid clip limitations arsenic accepted assets.

Looking astatine the rolling 3-month correlations of bitcoin CME futures versus a fewer of the risk-on indexes mentioned above, they each way astir the same.

Bitcoin CME futures correlated with risk-on assets.

Bitcoin CME futures correlated with risk-on assets.Although bitcoin has had its own, industry-wide capitulation and deleveraging lawsuit that rival galore humanities bottoming events we’ve seen successful the past, these relationships to accepted hazard haven’t changed much.

Bitcoin has yet acted arsenic the riskiest of each hazard allocations and arsenic a liquidity sponge, performing good astatine immoderate hints of expanding liquidity coming backmost into the market. It reverses with the slightest motion of rising equities volatility successful this existent marketplace regime.

We bash expect this dynamic to substantially alteration implicit clip arsenic the knowing and adoption of Bitcoin accelerates. This adoption is what we presumption arsenic the asymmetric upside to however bitcoin trades contiguous versus however it volition commercialized 5-10 years from now. Until then, bitcoin’s risk-on correlations stay the ascendant marketplace unit successful the short-term and are cardinal to knowing its imaginable trajectory implicit the adjacent fewer months.

Read the afloat nonfiction here.

Like this content? Subscribe now to person PRO articles straight successful your inbox.

Relevant Articles:

- A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global Liquidity

- The Everything Bubble: Markets At A Crossroads

- Just How Big Is The Everything Bubble?

- Not Your Average Recession: Unwinding The Largest Financial Bubble In History

- Brewing Emerging Market Debt Crises

- Evaluating Bitcoin’s Risk-On Tendencies

- The Unfolding Sovereign Debt & Currency Crisis

2 years ago

692

2 years ago

692

English (US) ·

English (US) ·