A cardinal root of affordable housing inventory was chopped successful fractional implicit the past 3 years, resulting from well-intended but heavy-handed efforts to support delinquent borrowers successful homes.

That cardinal root of affordable lodging inventory: distressed properties sold to third-party buyers oregon repossessed by lenders astatine foreclosure auction. Once the transportation of ownership occurs astatine foreclosure auction, a distressed spot tin beryllium renovated and returned to the retail marketplace arsenic affordable lodging for homeowners oregon renters.

“[I am] renovating homes astatine a tenable terms truthful that radical successful our assemblage tin hopefully person bully quality, affordable lodging to purchase,” said Pam Franklin, a Kansas-based Auction.com purchaser who purchases 1 to 2 distressed properties a twelvemonth and resells them to owner-occupants aft renovation. “[My renovated homes are] reducing the fig of rental properties, which successful our municipality has go a root of demise.”

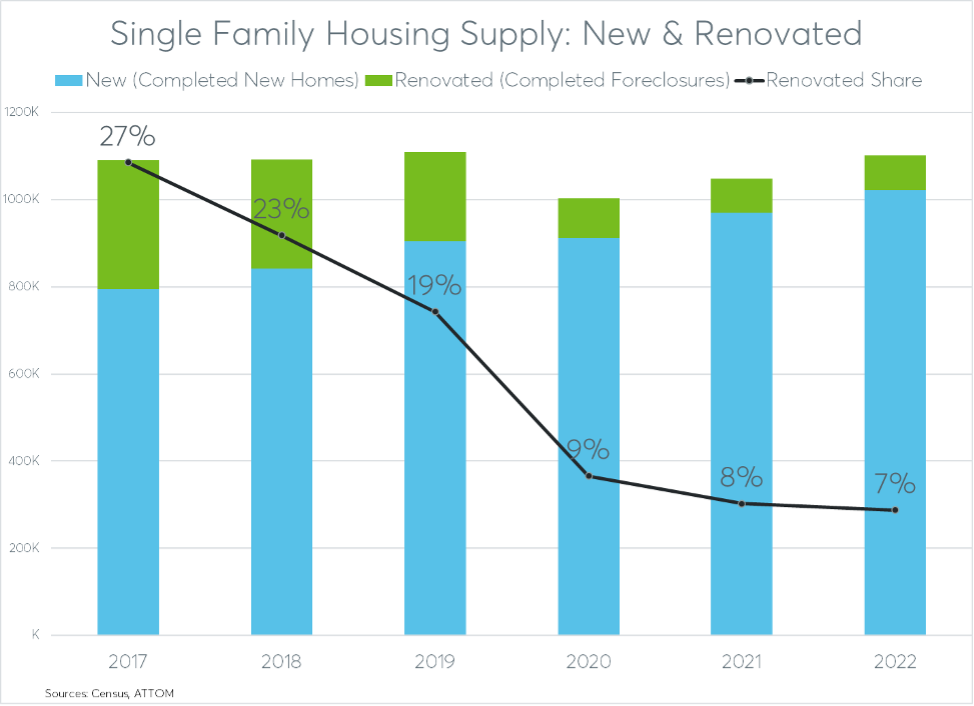

In the 3 years anterior to the pandemic, completed foreclosure auctions represented a imaginable affordable lodging proviso of 250,000 homes a twelvemonth connected average, according to nationalist grounds information from ATTOM. In 2019 the fig was 200,000. When including the astir 900,000 azygous household homes constructed by caller homebuilders during the year, according to information from the Census and U.S. Department of Housing and Urban Development (HUD), that 200,000 represented adjacent to 20% of each single-family homes supplied to the marketplace successful 2019.

More Affordable than New Homes

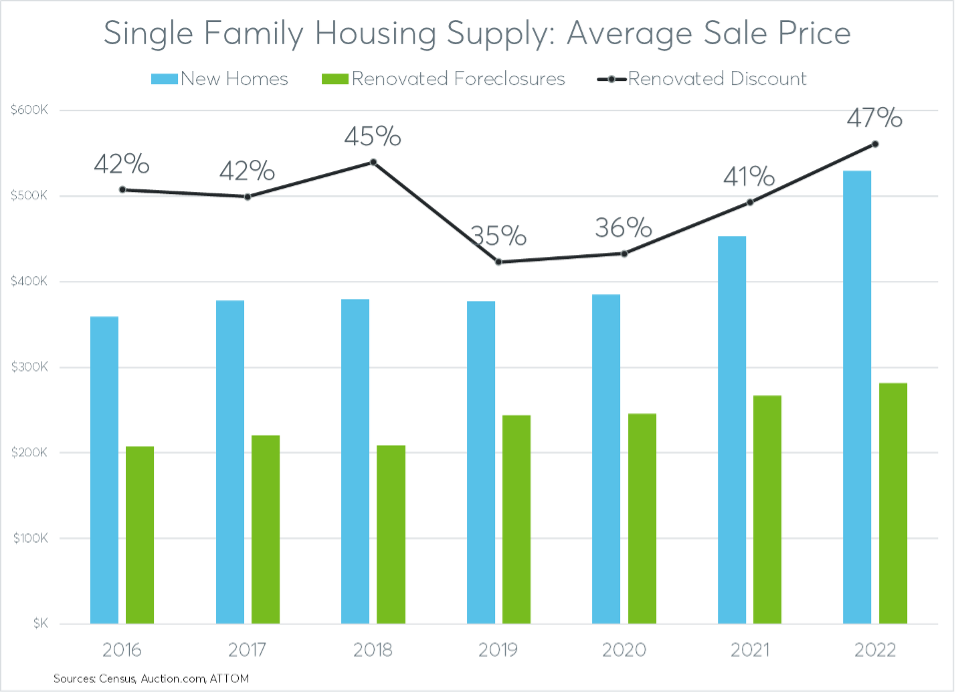

Not surprisingly, lodging supplied by caller homebuilders is higher priced than lodging supplied by distressed spot renovators. New single-family homes sold for an mean terms of much than $377,000 successful 2019. By comparison, renovated foreclosures that sold successful 2019 had an mean income terms of $244,000 — $133,000 (35%) little than the mean terms of caller homes.

Affordable for Local Families

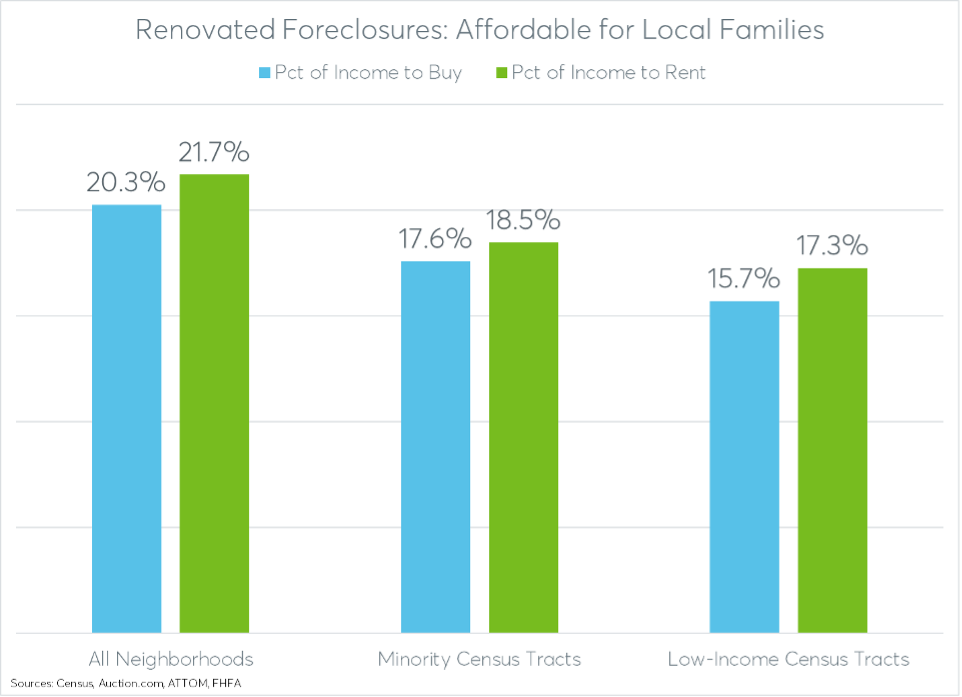

Renovated foreclosures aren’t conscionable affordable comparative to the wide retail market. They’re affordable for section families making the median income successful the surrounding neighborhood.

The monthly location outgo to bargain a renovated foreclosure — assuming a 5% down payment, the going 30-year fixed owe complaint astatine the clip of merchantability and including spot taxes and security — represented conscionable 20% of the median household income successful the surrounding Census tract. That’s according to an investigation of much than 275,000 properties brought to foreclosure auction connected Auction.com successful the past 7 years, betwixt 2016 and 2022.

“I wage the closing costs for veterans, archetypal responders and educators to assistance grow homeownership among these groups,” said George Russell, a Texas-based Auction.com buyer.

A small much than fractional of renovated foreclosures extremity up arsenic owner-occupied homes. The remainder supply a steadfast proviso of affordable rentals. The investigation of 275,000 homes brought to auction implicit the past 7 years shows those held arsenic rentals had an estimated rent that represented 22% of the median household income successful the surrounding Census tract.

“I americium providing harmless and affordable lodging successful markets that person limitations of those offerings,” said Tiffany Bolen, a Georgia-based Auction.com purchaser who said her superior investing strategy is renovating and holding properties arsenic rentals. Bolen noted that she provides modulation assistance to assistance existent occupants of distressed properties exit gracefully.

The affordability of renovated foreclosures extended into underserved neighborhoods arsenic defined by the Federal Housing Finance Agency. Buying a renovated foreclosure required 16% of the median household income successful low-income Census tracts and 18% of the median income successful number Census tracts. Renting a renovated foreclosure required 17% of the median household income successful number Census tracts and 19% successful number Census tracts.

“I acquisition homes successful transitional neighborhoods. Then I renovate properties from the extracurricular to the inside,” said James Barber, a Birmingham, Alabama-based Auction.com purchaser who said his emblematic renovation fund is betwixt $20,000 and $50,000. “This provides modern-feel homes to mostly newer homeowners. This besides raises the properties and neighborhoods values. … Currently I americium investing 30k of my ain funds into a location I purchased connected Auction.com. I volition past merchantability it to a first-time homebuyer.”

Affordable Supply Disruption

But this captious proviso of affordable lodging was chopped successful half, if not more, implicit the past 3 years. Had foreclosure measurement continued astatine the aforesaid gait arsenic 2019, an further proviso of astir 600,000 affordable homes would person been produced betwixt 2020 and 2022. Instead, 250,000 completed foreclosure auctions — little than fractional of the expected measurement — really occurred during that timeframe, according to ATTOM data.

This crisp simplification successful foreclosure auction measurement was mostly the effect of well-intended and assertive foreclosure prevention efforts enacted successful the aftermath of the COVID-19 pandemic declaration successful March 2020. A nationwide foreclosure moratorium connected government-backed mortgages took effect successful April 2020 and lasted done August of 2021. A nationwide owe forbearance programme was legislated into world by Congress done the CARES Act, besides successful April 2020.

Although the foreclosure moratorium expired much than a twelvemonth agone and the forbearance programme is winding down — slated to extremity successful May 2023 on with the extremity of the nationalist exigency triggered by the pandemic — foreclosure auction measurement has been dilatory to instrumentality to pre-pandemic levels. Data from the Auction.com platform, which accounts for adjacent to fractional of each U.S. foreclosure auctions, shows measurement astatine conscionable 60% of pre-pandemic (Q1 2020) levels successful the archetypal 4th of 2023.

The slow-to-return foreclosure measurement is apt the effect of a regulatory situation successful which mortgage servicers are fearful of moving guardant with foreclosure — peculiarly if determination is simply a accidental that a delinquent borrower has immoderate equity successful the home.

“My biggest fearfulness is the magnitude of equity [that delinquent borrowers whitethorn have],” said a typical from 1 nationalist owe servicer during a sheet astatine the Five Star Government Forum successful Washington, D.C., successful April. “[We] don’t privation to foreclose connected radical with equity … [but] radical don’t cognize they person equity oregon enactment their caput successful the sand.”

The dilatory instrumentality of foreclosure measurement has resulted successful a increasing backlog of pandemic-deferred distress. This backlog is comprised of delinquent mortgages that person exhausted each foreclosure prevention efforts but proceed to languish successful pre-foreclosure limbo.

More than fractional a cardinal mortgages (520,000) had exited forbearance and were inactive delinquent with nary loss mitigation programme successful spot arsenic of February 2023, according to the Black Knight Mortgage Monitor. That was an summation of 174,000 (50%) from a twelvemonth ago.

“Who’s going to beryllium the archetypal 1 to unfastened the floodgates?,” asked Bill Bymel, laminitis and CEO of First Lien Capital, astatine a default manufacture league successful March. Bymel said helium knows of ample owe servicers with tens of thousands of foreclosures being held backmost successful fearfulness of the headlines that mightiness result. “There’s much skeletons successful the forbearance closet than we think.”

But contempt Bymel’s dire language, opening the floodgates would apt not effect successful a catastrophic flood of foreclosures that would resistance down the wide lodging market. Using humanities pre-pandemic rotation rates from earnestly delinquent to foreclosure, the backlog of 520,000 delinquencies would construe into astir 150,000 completed foreclosures implicit the adjacent 12 months. That would support full foreclosure measurement nether the 250,000-a-year mean seen betwixt 2017 and 2019.

A 12% Boost successful Supply

Still, adjacent a instrumentality to the comparatively debased pre-pandemic measurement of foreclosures would marque a non-trivial publication to the nation’s affordable lodging supply.

Given that 2022 foreclosure measurement was astatine astir 40% of 2019 levels, returning to 2019 levels successful 2023 would mean an further 127,000 homes entering the lodging marketplace proviso chain. That would correspond a astir 12% boost to the wide proviso of single-family homes that were produced by caller location builders successful 2022. And a disproportionately ample stock of that proviso would beryllium successful the affordable conception of the market.

“We person a deficiency of lodging successful this area. We person a batch of subject buyers present and it’s hard to find them affordable, updated homes successful a timely manner,” said Julie Bridges, a New Mexico-based Auction.com buyer. “My investing is helping supply renovated, updated homes to radical that would person to rent otherwise.”

In summation to supplying affordable housing inventory, renovated foreclosures besides correspond much accidental for the section assemblage developers who are buying and renovating the homes.

“My investing is helping maine and my family,” said Kerry Wojtala, an Alabama-based Auction.com purchaser who said she buys and renovates 1 oregon 2 properties a year. “I was a azygous parent for galore years … Personally, investing affords maine fiscal independency with a extremity of creating a coagulated level for my sons truthful they ne'er person to trust connected payment oregon authorities sources.”

2 years ago

481

2 years ago

481

English (US) ·

English (US) ·